Plan sponsors and consultants express high levels of satisfaction with the services they are receiving from their retirement recordkeepers, according to a recent Coalition Greenwich study. However, both groups are asking recordkeepers to step up their offerings and services.

Our data shows that, overall, plan sponsors are satisfied with the performance of their recordkeepers. More than 80% of plan sponsors in this study rate their recordkeepers as “excellent/very good” in plan services such as reporting, administrative support and regulatory and compliance communications. A similar share of plan sponsors give top ratings to the retirement savings tools provided by their recordkeepers. Plan sponsors named Vanguard as the No. 1 recordkeeper in terms of overall satisfaction. Fidelity and Vanguard were most frequently recommended by consultants.

Plan sponsors also express strong satisfaction with most aspects of recordkeeper technology platforms. Close to three-quarters of plan sponsors rate the digital experience recordkeepers deliver to them and their participants as excellent/very good, with large majorities awarding top grades to recordkeeper websites and analytical tools.

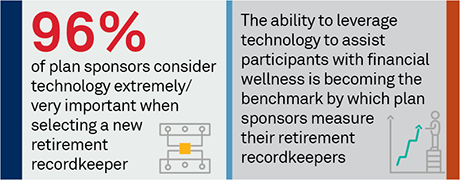

However, in a world of increasingly complex and challenging markets, plan sponsors are asking their recordkeepers to expand their offerings to help them guide plan participants to better overall outcomes. Consultants are looking for recordkeepers to improve the simplicity, interactivity and mobile access of technology offerings. Plan sponsors want their recordkeepers to help educate participants about financial issues, advise them on financial planning and strategy, and equip them with increasingly sophisticated financial products—including enhanced target-date funds (TDFs), and environmental, social and governance (ESG) offerings that allow participants to align their strategies with their values.

Going forward, recordkeeper performance will increasingly be judged on the ability to meet these new demands, and help plan participants achieve a state of financial wellness.

MethodologyIn Q4 2021 and Q1 2022, Coalition Greenwich interviewed 145 U.S. plan sponsors and 15 U.S. consultants in a blind study designed to gain a better understanding of the retirement recordkeeping industry. Respondents were asked to assess the quality of service they receive from recordkeepers across a variety of categories, and to identify what they see as the most important criteria for rating and selecting a recordkeeper. Sponsors were also asked to prioritize the products and services they currently receive from recordkeepers, and to identify the offerings they would value most highly in the future. Finally, both groups were asked a series of questions about important products and issues, including target date funds (TDFs) and environmental, social and governance (ESG) investing. The study results were supplemented with phone interviews with 35 plan sponsors.