Climate change is a slow-burning crisis that is transforming the investment landscape. Over half the 101 global institutional investors participating in a new joint PGIM-Greenwich Associates study say climate change is already affecting their portfolios by creating new risks and generating new opportunities. Of those investors who do incorporate climate change into their portfolios, 67% actively consider the investment risk from climate change in their portfolios, while almost as many (56%) consider investment opportunity.

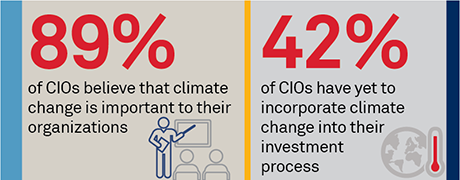

Two distinct gaps emerged from the global survey of CIOs around their approaches to climate change. First, there was an “action gap.” That is, while global institutional investors overwhelmingly recognize climate change is critical, significantly fewer of them are taking action to address the climate crisis. Second, investors in different regions had starkly different views and tendencies, resulting in a “regional gap.”

The Action Gap

Nearly 90% of institutional investors surveyed in Europe, North America and Asia-Pacific believe climate change is an important issue for their organization—and roughly 60% of them believe climate change has already begun to impact their portfolios. Nevertheless, despite wide recognition of the issue, there is an action gap, as significantly fewer have taken measures to address it. Globally, more than 40% of investors have yet to incorporate climate into their investment processes at all.

Significant data gaps may be one factor behind the action gap. Institutional investors who have not acted on climate change cite uncertainty regarding how to incorporate unreliable climate metrics and models into their portfolios.

The Regional Gap

The study of institutional investors also identified a regional gap. Over 80% of European investors actively incorporate climate change into their investment processes—more than one and a half times the rate of their Asia-Pacific counterparts. Only a minority of North American study respondents go this far.

While there are multiple reasons why more European and Asia-Pacific investors are acting on climate change than their North American counterparts, three key themes emerged from investor studies: differences in regulation, funding status and prevailing views on fiduciary obligations.

MethodologyFrom April to August 2020, PGIM partnered with Greenwich Associates to conduct a study of institutional investors to understand the hidden risks associated with climate change, the emerging investment opportunities associated with a transition to a greener planet, as well as how CIOs incorporate climate into their data analytics and investment process (if at all). Greenwich Associates interviewed 101 institutional investors with greater than $3 billion in assets across North America, Europe and Asia-Pacific.