Table of Contents

Bigger funds from established players. That’s what wholesale investment fund distributors in Europe and Asia have been emphasizing, as investors on their platforms seek out the perceived safety of large funds and fund providers in the midst of a historic market drawdown.

That preference for size and reliable service is playing to the strengths of the world’s biggest asset managers, like Allianz Global Investors, which earned the title of 2022 Greenwich Quality Leader in Intermediary Fund Distribution in both Europe and Asia. Several of these large managers are also benefiting from their early commitment to environmental, social and governance (ESG) policies, which are being added as a requirement by a growing number of fund distributors in both Asia and Europe.

Fund distributors and asset managers spent much of the past six months contending with asset outflows that began in earnest in March, when the U.S. Federal Reserve hiked interest rates by a quarter of a percentage point. Even before that event, investors, distributors and fund providers were navigating an environment of mounting risk related to Russia’s February invasion of Ukraine, accelerating inflation and the lingering economic and social consequences of the global pandemic.

Throughout this year, asset outflows have been especially pronounced in fixed income and, in Asia, on “mass market” platforms like retail banks and insurance companies, where retail investors pulled funds as the severe market drawdown unfolded. As investors reallocated assets, they tended to favor name-brand funds.

“When markets are seemingly in freefall, issues of redemptions and liquidity become relevant to investors and their advisors,” says Coalition Greenwich Head of APAC Investment Management, Parijat Banerjee. “That was exactly the environment in the first half of this year, and distributors found more confidence in promoting the biggest and most well-established funds.”

Conversely, the preference for big funds and well-known brands created a difficult environment for smaller funds. “It hasn’t been a great time to be trying to get distribution for a new fund in either Europe or Asia,” says Coalition Greenwich Senior Relationship Manager Sophie Emler.

Standing Out with Client Service and Digital Platforms

Allianz Global Investors and other large asset managers are standing out from the competition this year not just due to their size, but also due to client service capabilities that have helped investors make informed decisions in this period of epic volatility. Fund distributors rank “market-view” seminars from fund providers as second in importance only to effective product information, in terms of the sales support they receive from managers on their platforms. Allianz and other leading managers are committed to providing this type of high-quality service, which helps distributors support clients and helps investors on the platform produce better outcomes.

The biggest fund providers also have the resources to deploy sophisticated digital capabilities that allow them to deliver information to clients in the timeliest manner—a critical advantage in uncertain markets. When assessing the value of digital services provided by managers, fund distributors rank timely market updates and analysis as by far the most important, topping even critical features like fund updates and product information.

Asia: Managers Target HNW Investors

For the past several years, asset managers competing in Asia have been focusing their growth strategies on distribution platforms like private banks and wealth management that cater to high net worth investors. That trend has accelerated over the past six months. With mass investors in “risk-off” mode, assets on HNW platforms have proved much stickier than assets on retail banking and insurance platforms. “HNW investors are more likely to view volatility as a buying opportunity,” says Parijat Banerjee.

This stability is critical for asset managers, whose costs are relatively fixed but whose revenues fluctuate with asset flows. As a result of those trends, smaller fund providers and asset managers who traditionally focused on institutional clients are both targeting private bank and insurance channels, bringing increased competition to this attractive market segment.

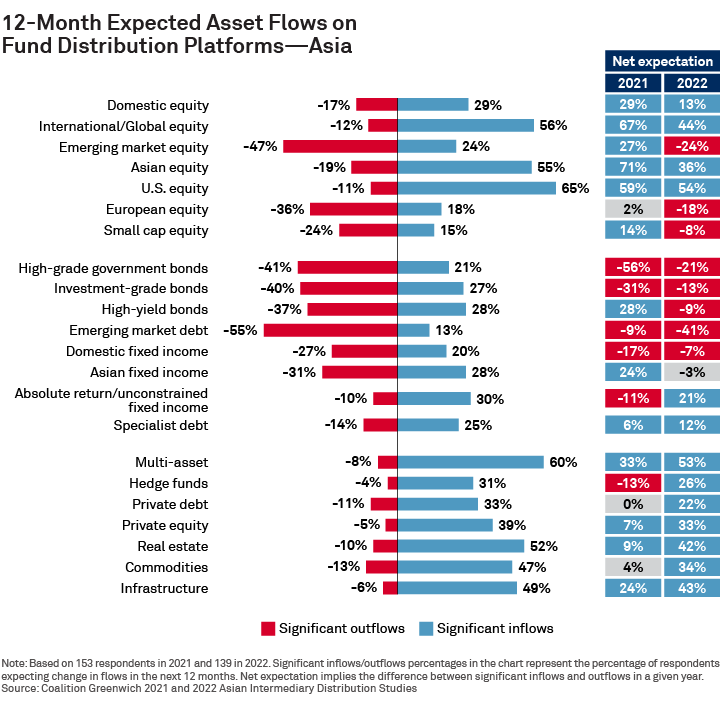

Looking ahead to the remainder of 2022 and beyond, Asian fund distributors are hopeful that conditions will improve for certain asset classes. In fact, when it comes to future flows in U.S., Asian and international equity, distributors are surprisingly optimistic. The outlook is decidedly less positive for fixed income. Distributors are trying to help investors on their platform remain nimble and adjust to unfavorable market conditions. At the moment, that means an emphasis on shorter-duration strategies.

Despite any hopes for a rebound, fund distributors expect to see continued outflows of riskier assets—especially emerging market debt and equity. “Given the pressure U.S. rate hikes can cause for emerging market economies, it’s hardly a surprise that roughly half of Asian fund distributors expect to see significant outflows from EM equity and debt over the next 12 months,” says Senior Relationship Manager Arifur Rahman.

At the other end of the spectrum, Asian fund distributors expect to see continued inflows into multi-asset products and into alternative asset classes—especially real estate, commodities and infrastructure.

Europe: A Bearish Mix

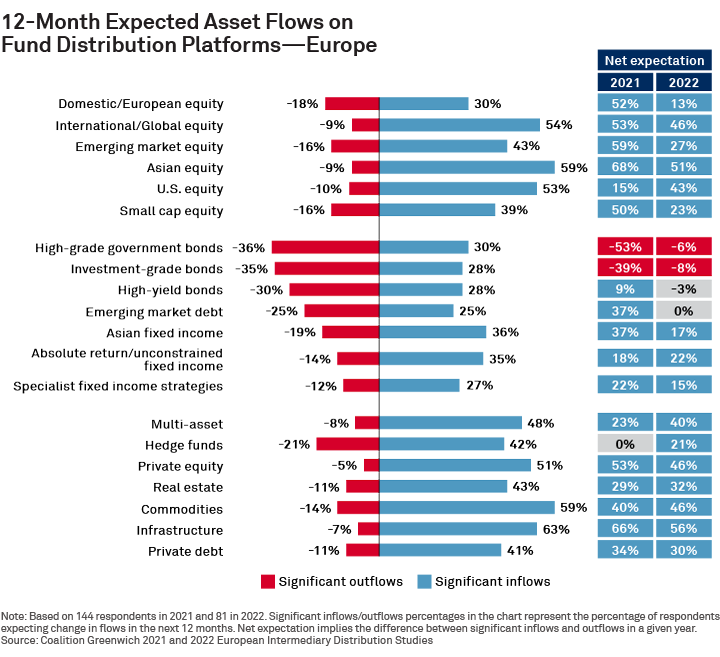

The war in Ukraine, a still-unfolding energy crisis, troubling inflation, fears of recession, a market selloff, supply-chain disruptions, and continued effects from COVID-19 have combined for a bearish mix of conditions for investors in Europe. The result has been consistent outflows on fund distribution platforms, with fixed income getting hit particularly hard. Looking ahead, fund distributors expect that weakness to continue. Over the next 12 months, distributors expect to see net outflows in high-grade government bonds, investment-grade bonds and high-yield bonds, and flat net asset flows for emerging market debt. On a more positive note, fund distributors do expect to see healthy inflows resume into most equity strategies and to continue for the full range of alternative asset classes. “Across all asset classes, European fund distributors are putting an emphasis on scale and on managers with a proven track record—not just in terms of absolute performance, but in terms of having a history of weathering crises, supporting clients and maintaining stability in the investment teams that run their funds,” says Sophie Emler.

Rethinking ESG

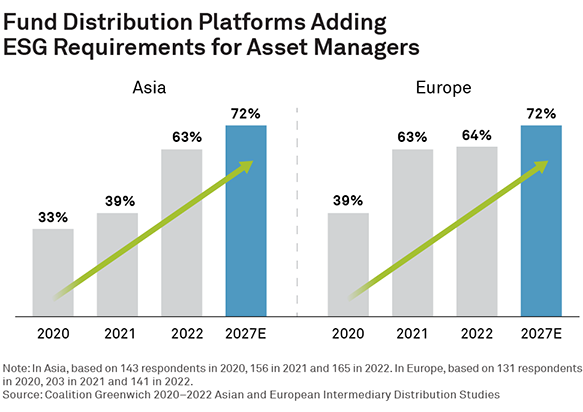

Although the global market downturn might have slowed the flow of investors assets into ESG funds, Coalition Greenwich data suggests that the long-term trend of ESG integration into investment markets will continue unabated. The reason: In both Europe and Asia, growing numbers of fund distributors plan to require managers to have a “clearly articulated ESG approach” and ESG compliant funds in order to quality for inclusion on their platforms. As shown in the nearby chart, more than 60% fund distributors have adopted these ESG requirements, and almost three-quarters expect to have the requirements in place in the next five years.

While requirements from fund distributors virtually ensure that asset managers will continue incorporating ESG and rolling out ESG funds, the industry is still in the process of defining ESG and adopting common standards. European regulators are leading that charge with the development of rules like the EU Taxonomy, which is intended to bring clarity to market participants by determining which economic activities are sustainable.

Those efforts, and similar initiatives by governments, non-governmental organizations, industry groups, and individual companies, are needed to eliminate “greenwashing” and give investors and corporate issuers confidence in ESG investments. Approximately 40% of fund distributors in Asia and Europe say difficulty measuring the true impact of ESG strategies is a serious impediment to increasing the amount of ESG assets in client portfolios.

Fund distributors cite another major challenge in getting investors to allocate assets to ESG funds offered on their platforms: continued questions about performance. In Asia, performance concerns now rank as the No. 1 constraint to increasing ESG in client portfolios, cited as a major issue by 44% of fund distributors.

Even in Europe, where ESG has advanced fastest in investment markets, more than a quarter of fund distributors say concerns about performance are limiting the growth of ESG in investor portfolios. “In bull markets, when investments overall are doing well, it’s much easier to take a chance on performance in order to instill important ESG standards into the portfolio,” says Parijat Banerjee. “In a severe downturn, decisions become more bottom-line oriented, and investors are looking for harder data on performance impact.”

Even as investors assess performance and regulators construct standards, global events are forcing some investors to reconsider some common ESG practices—especially in Europe. For example, many of the earliest ESG strategies use negative screens to exclude from platforms and fund portfolios industries and assets that run afoul of ESG standards. “The need for arms in Ukraine and for fuel in a deepening energy crisis is causing many investors to wonder if more sophisticated approaches to ESG are required,” says Sophie Emler.

Global Head of Investment Management Mark Buckley, Head of APAC Investment Management Parijat Banerjee, Sophie Emler, and Arifur Rahman advise investment management clients in Europe and Asia.

MethodologyCoalition Greenwich conducted 168 interviews with some of the largest fund distributors in Asia and with 164 fund distributors in Europe. Senior gatekeepers were asked to provide detailed information on their business priorities, quantitative and qualitative evaluations of their investment managers, and qualitative assessments of those managers soliciting their business. Countries and regions where interviews were conducted in Asia include Hong Kong, Macau, Singapore, South Korea, Taiwan, Malaysia, and Thailand. In Europe, interviews were conducted in Austria, Benelux, France, Germany, Greece, Iberia, Ireland, Italy, Monaco, Nordics, Switzerland, and the United Kingdom.