This report is based on the results of a special study, conducted by Greenwich Associates in partnership with Lord Abbett, to better understand how institutional investors viewed the risk, liquidity and return profiles of their portfolios just before the onset of the COVID-19 crisis. The study data reveals that even before the latest set of challenges related to the pandemic, and even more so now as institutions recalibrate their portfolios in response to today’s unprecedented conditions, many would benefit from assets that can potentially help utilize their privileged liquidity position, protect principal and enhance yields.

A number of the institutions have been finding these qualities in short duration credit strategies. At the onset of the crisis, institutional investors were using short duration credit to optimize cash holdings—an important function for plans that had been increasing cash positions in preparation for just such an event. Institutions were also using the product as a complement to core fixed-income allocations and as a way to access credit spread while limiting default risk, with the end goals of enhancing yield while managing liquidity and principal risk.

The COVID-19 crisis has elevated the awareness of and need for portfolio liquidity, while also intensifying institutions’ need to enhance yields to address what could be acute, long-term funding shortages. We believe short duration credit can be integrated into tiered liquidity management programs that balance the need for elevated near-term liquidity with the desire for more yield available in the credit markets.

Fed action and increased market demand for fixed income have resulted in starkly lower yields for long-term government bonds and core fixed-income portfolios, leaving credit spreads in an advantaged position to potentially provide portfolio yield. However, not all credit is created equal: Elevated default risk and sector dispersion highlight the need for a focus on near-term maturities and an active, multi-sector approach, in our view.

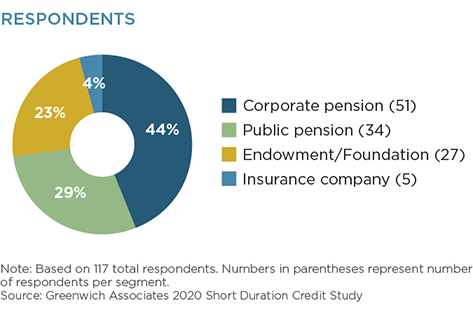

MethodologyFrom February to March 2020, Greenwich Associates, in partnership with Lord Abbett, conducted a study of institutional investors to understand the challenges they face and changes they have made to their portfolios in seeking to enhance returns while managing risk and liquidity. Greenwich Associates interviewed 117 U.S. institutional investors, including corporate pension plans, public pension plans, endowments and foundations, as well as several insurance plans.