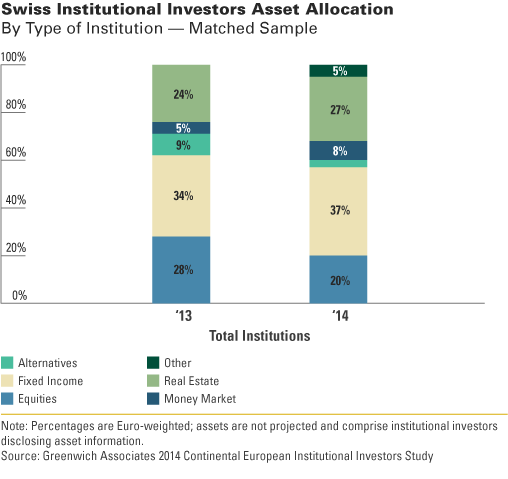

Results from the Continental European Institutional Investors Study revealed that institutional investors marginally increased their allocations to fixed income, while slightly reducing their exposure to equities. Fixed income makes up 37% of portfolios versus 34% in year prior. The trend (↑ fixed income, ↓ equities) mirrors the overall allocations for total European investors on their hunt for return.

Other Findings to Help Support Your Business Strategy:

- Swiss investors identify asset return expectations as the key driver for allocation changes, again mirroring overall themes with Continental Europe. Market volatility, funding position and liability profile were also recognized as key influencers.

- With regard to strategic decision-making on investments, many Swiss funds cited the low interest rate environment and regulation effects as important issues facing the fund.