Table of Contents

- 1.Executive Summary

- 2.Introduction: The Steady Spread of Sustainability

- 3.Asset Owners Move Toward Full ESG Integration

- 4.The Next Challenge: Measuring Impact

- 5.Selecting Sustainable Managers and Mandates

- 6.Targeting Impact with Thematic Strategies

- 7.Environment, Climate Change Fueling Interest in Thematic Approaches

- 8.Conclusion

Executive Summary

As asset owners around the world commit to aligning their investment objectives to the UN’s Principles for Responsible Investment, institutions face the complex task of putting that code into practice by integrating environmental, social and governance (ESG) criteria into their investment processes and portfolios. As they do so, individual asset owners are searching for the sustainable investing techniques that prove most effective at outperforming equity benchmarks while maximizing the positive impact of their investments.

Although the investment industry has created a variety of approaches to sustainable investing, most asset owners are moving in the direction of a full integration of ESG factors into their investment process and across all portfolios. Increasing numbers of institutions have started to incorporate allocations to sustainable thematic investment strategies they see as having the potential to enhance impact levels, diversify portfolios and provide an additional source of alpha generation.

Regardless of which approach asset owners ultimately select, the decision on how to implement ESG criteria will have important ramifications for all institutions, as growing shares of assets and portfolios fall under the umbrella of sustainability. At the same time, critical constituencies like regulators, boards, investment committees, pension plan participants, and the public at large are beginning to incorporate measurable environmental and social impact alongside traditional performance metrics as a standard component of investment performance measurement.

Introduction: The Steady Spread of Sustainability

In 2016, about half (52%) of asset owners participating in a previous study conducted by Greenwich Associates in 2016, study had incorporated some element of sustainability into their investment processes. Five years later, that share is closer to three-quarters (72%). Looking ahead, nearly 8 out of 10 institutions expect to have adopted sustainability criteria into investment decision-making processes by 2026.

As a study participant from a U.S. corporate pension fund explains, “[Sustainable investing] will continue to surge, driven by increasing consumer demand, and more investors will likely recognize that sustainable funds provide returns comparable to traditional funds, in addition to lower risk.”

European institutions are leading the charge, with 85% of European pension plans, endowments and foundations now incorporating sustainability, compared with two-thirds of North American asset owners. Across both regions, corporate pension plans have been fastest to embrace sustainability, followed by endowments and foundations and, finally, public pensions.

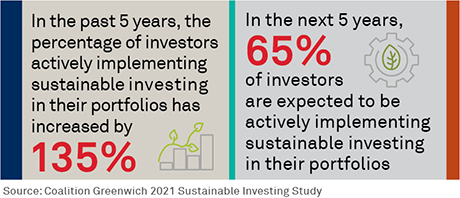

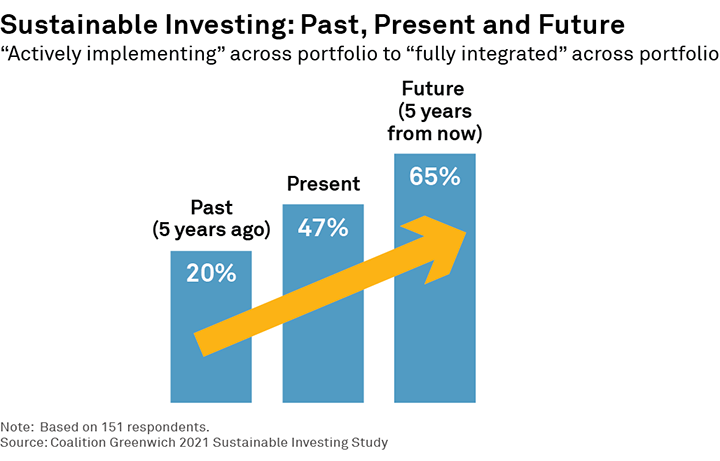

Sustainability is also spreading within individual organizations. Five years ago, most asset owners employing sustainability criteria were using these factors in only a discrete portion of their portfolios. At that time, roughly 1 in 5 institutions overall were employing sustainability criteria across all assets. Today, nearly half (47%) of asset owners apply sustainability metrics to all their portfolios, including 13% who say sustainability criteria are now “fully integrated” into their investment processes. Although the COVID-19 crisis accelerated many existing trends in financial markets, that does not seem to be true for sustainable investing.

Asset Owners Move Toward Full ESG Integration

Expectations among asset owners today provide clues about what sustainable investing will look like in the future. In five years’ time, about two-thirds of asset owners expect to be employing sustainability metrics across their entire portfolios. That includes 40% of institutions planning to “fully integrate” sustainability criteria into their portfolios and investment processes. In Europe, more than three-quarters of asset owners expect to be using sustainability criteria across all assets by 2026. By that time, only 14% of asset owners overall expect to be limiting sustainability to selective portfolios.

“I think we will be more actively involved and will be fully integrated in every type of investing,” says a study participant from a European corporate pension fund. “We will review investments against a scorecard of ESG. We will measure managers against that scorecard and exclude managers lacking an ESG orientation.”

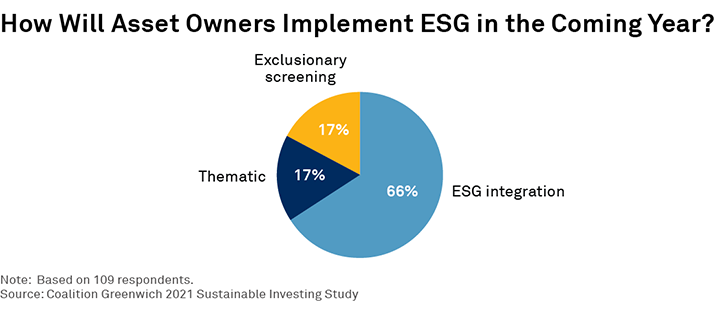

In a shorter timeframe, we asked asset owners to describe the approach they will be using for sustainable investments in the year ahead. Responses indicate just how far sustainable investment practices have evolved already. In many cases, institutions first introducing sustainability to their investment portfolios start by implementing relatively simple exclusionary screens for tobacco, alcohol or fossil fuel production. However, only 17% of study participants plan to use exclusionary screening as an “investment thesis” for sustainability in the coming year. Instead, two-thirds expect to use the approach of broader ESG integration into their investment processes.

As an endowment respondent explains, “Over the coming years, sustainable investing will evolve to be fully integrated across investment portfolios from both a risk and opportunity perspective. This will be a function of greater mainstream investor awareness, an evolution of solutions and modeling specific to the financial industry, and the opportunity set created by the sizable global economic transition that has already begun.”

The Next Challenge: Measuring Impact

Our study provides a valuable snapshot of sustainable investing in 2021—a moment in time when asset owners are focused on integration. However, after years of surprisingly rapid progress on the integration front, the industry is fast approaching an inflection point. As the representative of a foundation explains, “In five years, we will be finished with qualitative and definition stages.” As more asset owners establish their in-house frameworks and begin meaningful allocations to specific sustainable strategies, the industry’s focus will quickly switch from adoption and incorporation to results.

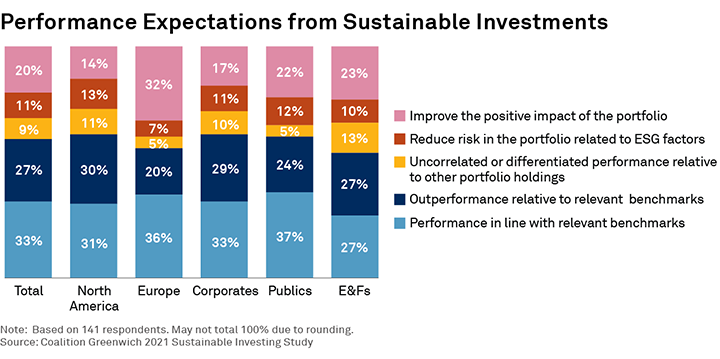

In terms of results, the study data make clear that despite asset owners’ increasing commitment to sustainability, they are not in the philanthropy business. As the following graphic illustrates, institutions expect their sustainable investments first and foremost to generate attractive investment returns, either matching or outperforming benchmarks, with many also expecting additional benefits such as portfolio diversification or enhanced risk management through the reduction of ESG-related risks.

Going forward, however, asset owners and their managers will come under mounting pressure from both internal and external stakeholders to document the positive impact of their investments. European asset owners already rank impact as nearly on par with goals like matching or outperforming their benchmark. As these and other asset owners turn their focus to documenting impact, they are finding that they—and the industry as a whole—still have work to do.

When it comes to measuring the financial performance of their sustainable investments, asset owners generally choose between two well-established options: Almost 45% benchmark investment performance in sustainable investing funds to a broad equity market benchmark, while about 30% use ESG or specialty benchmarks.

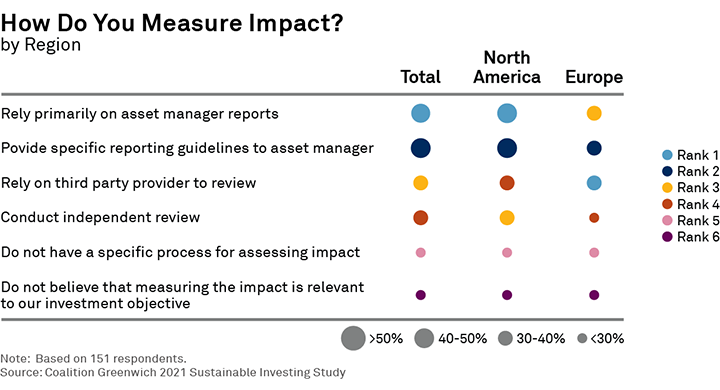

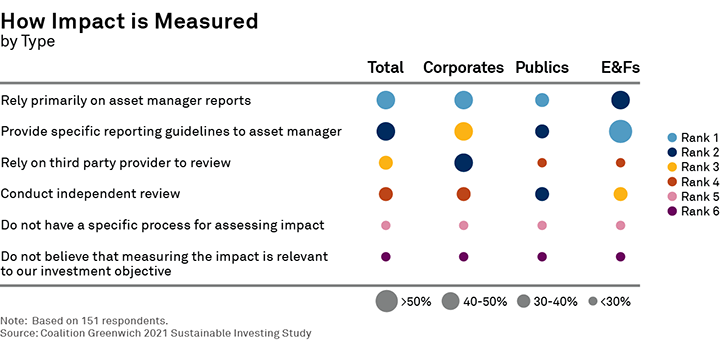

Things are much less clear-cut for impact. Asset owners can select from a diverse range of options for measuring impact. They can choose to measure it at the security level, portfolio level and/or asset-manager level. They can rely on impact reporting from their asset managers, utilize data, ratings and assessments from investment consultants and other third-party providers, or they can attempt to quantify impact on their own. Currently, there is no consensus among institutions about how best to approach the task.

About 1 in 5 institutions—and about a quarter of U.S. asset owners—don’t have a process in place for measuring the impact of their sustainable investments. “We are literally just starting, very much in an experimental phrase,” explains one European corporate pension.

Roughly a third of institutions employ an external provider—often an investment consultant— to review and assess impact. About the same share say they conduct their own independent impact reviews.

Most institutions rely on reports from their asset managers, including some asset owners who provide managers with specific guidelines on how to report impact. “We’re reliant on portfolio managers, but have given them each five to eight questions that they have to answer at each review,” says one European corporate pension fund.

Regardless of the approach they employ, one of the biggest challenges asset owners face in measuring the impact of their sustainable investments is a lack of reliable third-party data. ESG data is still very much a work in progress. Ratings and results differ significantly from provider to provider, based on the goals of their reviews and the methodologies they employ. The lack of consistency in ESG data complicates both the process of allocating sustainable investment dollars and measuring the impact of those investments.

Selecting Sustainable Managers and Mandates

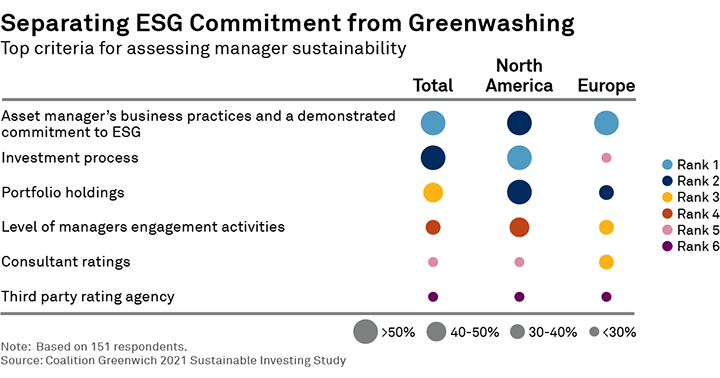

Asset owners looking to allocate to sustainable strategies start with an assessment of managers’ overall business practices and demonstrated commitment to ESG. “Asset managers with the biggest commitment to sustainability have created clear frameworks and processes for incorporating sustainability thoughtfully into their investment research and portfolio construction approach,” explains a representative of a European corporate pension fund.

To some extent, those assessments are informed by third-party ESG data and consultant advice. But many asset owners are digging deeper into managers’ investment processes and portfolios, looking for specific attributes. For example: Does the manager maintain its own internal ESG research capabilities and conduct proprietary ESG analysis? Has the manager demonstrated a pattern of active ownership through proxy voting? And finally, does the company actively engage with management of portfolio companies to advocate for positive change? Affirmative answers to these questions suggest that the manager is demonstrating a true commitment to maximizing impact, as opposed to “greenwashing.”

“[Managers] can demonstrate their commitment by how they articulate policy and evidence that they carry it through,” says one public plan. “We’re looking for quality of thought and evidence that it isn’t just a paragraph in a marketing pitch, but that their statement is reflective of how they approach their investment process and how they measure the results.”

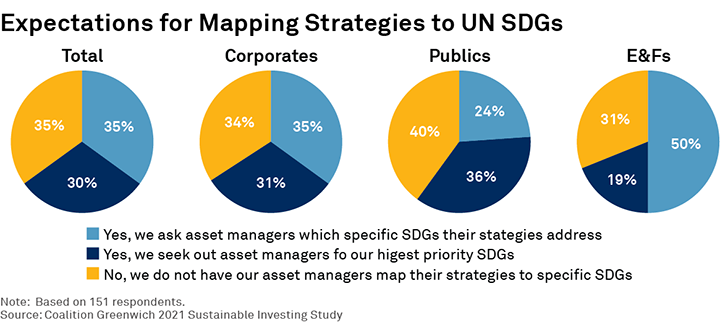

About two-thirds of asset owners examine managers’ commitment to specific UN Sustainable Development Goals, with about 35% of study respondents reporting that they ask managers to cite the specific SDGs their strategies address, and 30% saying they specifically seek out managers whose funds best align with their own highest-priority SDGs.

While the UN’s 17 Sustainable Development Goals establish targets for achieving peace and prosperity, it can be challenging for investors to measure the impact for the following reasons:

- Standard methodology to measure investor exposure has not been established

- Macro-level goals have not been aligned to security- or fund-level goals

- Goals have not been aligned with one another and can, at times, contradict

- Corporate data required for estimates is highly inconsistent

Targeting Impact with Thematic Strategies

Asset owners in the study are increasing their use of thematic investment strategies as tools to help measure and maximize impact. Sustainable thematic investment strategies focus on one or more issue areas where social or environmental need is spawning commercial growth opportunities, creating the potential for both attractive investment returns and positive impact.

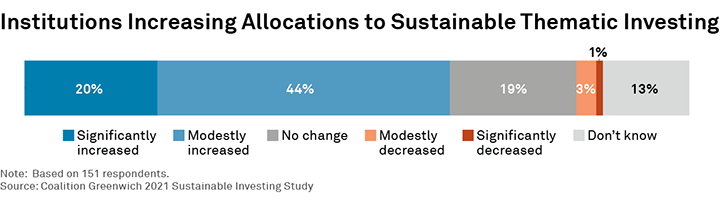

Two-thirds of institutions in the study increased allocations to sustainable thematic investing strategies over the past three years. Today, three-quarters of the institutions employ these strategies in their equity portfolios. (Approximately 60% of study respondents are also using sustainable thematic investment strategies in fixed income, as are 50% in alternatives.)

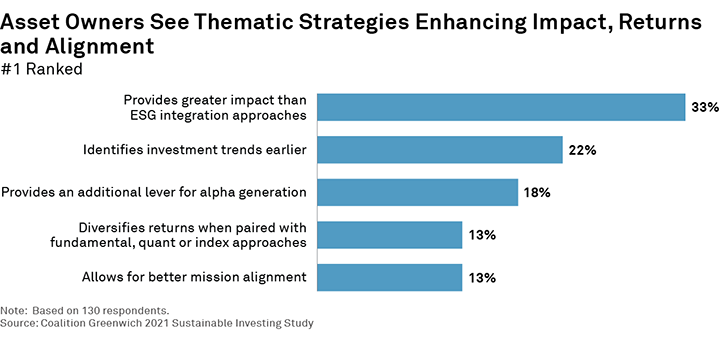

Many asset owners are utilizing allocations to thematic strategies in an effort to integrate ESG investments into portfolios. This framework is becoming increasingly popular in part because many asset owners believe that thematic investing generates greater impact than ESG integration approaches. “[Thematic investing] allows us to support the company’s mission to help people live healthier lives,” says a representative of a corporate pension fund.

In addition, asset owners believe thematic investment strategies are able to identify investment trends earlier than other approaches, a feature that probably contributes to the corresponding belief on the part of some institutions that thematic strategies provide an additional lever for alpha generation. Institutions also say they are drawn to sustainable thematic investment strategies for diversification benefits in portfolios that also include fundamental, quantitative and index approaches.

Environment, Climate Change Fueling Interest in Thematic Approaches

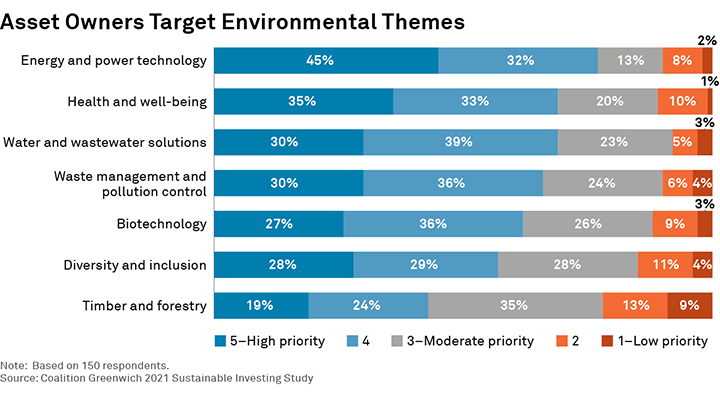

The graphic below shows the sustainable investment themes targeted most often by asset owners as they allocate to these strategies. While important issues like health and well-being, and diversity and inclusion appear on the list, the environment is by far the biggest priority for institutions selecting thematic strategies.

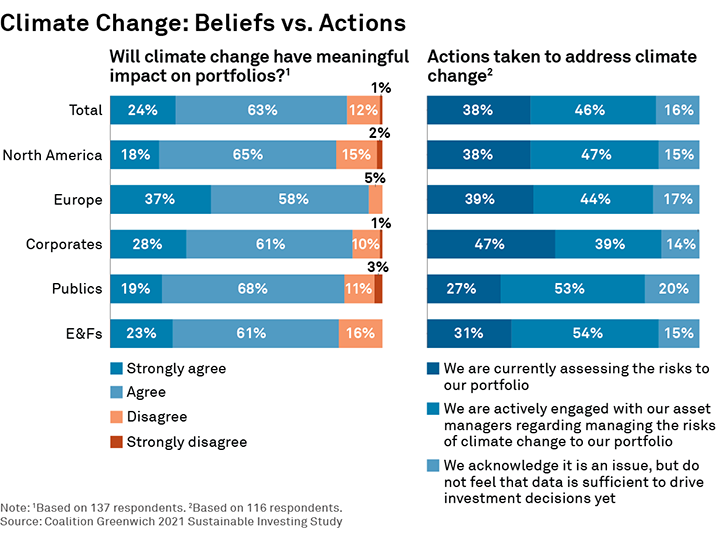

That focus on the environment should continue attracting asset owners to thematic strategies. As the next graphic demonstrates, asset owners still have significant ground to cover when it comes to aligning their portfolios with their own environmental beliefs and values. Although nearly 90% of asset owners believe climate change will have a meaningful impact on their portfolios, fewer than half of institutions are working with asset managers to actively manage climate risks. As the representative of a European corporate pension fund says, “We believe climate change is an issue, but we do not have the necessary data to determine what elements will have the greatest impact on our portfolio yet.”

The representative of a foundation seemed to describe the current status of many study participants by explaining, “We are increasing our level of discussion and engagement with our asset managers about how they approach this issue so that we can begin to develop more concrete policies.” The need for concrete policies to mitigate climate risk and effective strategies to capitalize on opportunities created by the transition to renewable power should fuel continued demand for thematic strategies focused on the environment and the fight against climate change.

Conclusion

Asset owners around the world are gravitating to a strategy of full integration of ESG criteria into their portfolios. As they make progress on the complex challenge of integrating sustainability metrics into their investment policies and processes, they now face the equally daunting task of ensuring that their investments are actually delivering positive impact.

One approach used by growing numbers of asset owners is to supplement integrated ESG investments with allocations to thematic sustainable investment strategies that they see as more effective at generating impact in critical areas like the environment and climate change, while also diversifying portfolios and potentially enhancing alpha generation. These benefits become increasingly important to asset owners as they move past the integration phase and start making sustainable investments, the results of which will be measured in terms of both investment returns and documented impact.

Davis Walmsley, Coalition Greenwich Head of Client Relationships, Investment Management, advises on the asset management market globally.

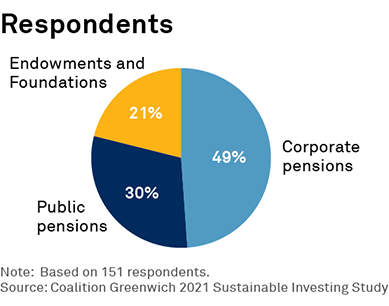

Coalition Greenwich conducted 151 telephone and online interviews targeting corporate pensions, public pensions, and endowments and foundations based in North America and Europe to examine investors’ evolving sentiment toward sustainable investments and current thinking about portfolio implementation and reporting. The interviews took place between February and April 2021.

The study that this report is based on was commissioned by AGF Investments and conducted by Coalition Greenwich, a division of CRISIL.