Table of Contents

European institutions contending with a set of formidable challenges—including sweeping regulatory reforms, persistently low interest rates and the threat of increased volatility—are turning to asset management firms for advice and assistance on these critical issues. That demand for support is giving a boost to pan-European, multi-asset-class managers like Allianz Global Investors—the 2017 Greenwich Quality Leader℠ in Continental European Institutional Investment Management.

As part of its 2017 research program, Greenwich Associates interviewed 757 key decision-makers at Europe’s largest institutional investors. These professionals were asked to name the external asset managers their organizations employ and to rate the quality delivered by these firms in a series of investment and service categories. Firms that receive client ratings topping those awarded to competitors by a statistically significant margin were named Quality Leaders. “In 2017, only AllianzGI qualifies for that title,” says Greenwich Associates Managing Director Markus Ohlig.

AllianzGI and other large asset managers are benefiting from institutions’ requests for assistance on three issues rated as top-of-mind by the investment professionals participating in the Greenwich Associates study:

- The need to comply with new regulations and standards;

- Concerns about increasing volatility levels, and

- Finding incremental investment returns in an era of low interest rates and yields.

Adapting to Regulations, ESG Considerations

European institutions are working to comply with a raft of new Europe-wide regulations, including EMIR, Solvency II and MiFID II, as well as reforms at the national level. At the same time, institutions are revamping internal practices in accordance with environmental, social and governance (ESG) considerations, socially responsible investing (SRI) and other standards taking deeper hold in the investment industry and in their own organizations. The second issue cited by study participants might come as a surprise, since volatility levels in equities and fixed income have been hovering near historic lows. However, portfolio managers and other investment professionals are anxious about a host of political, regulatory and market/economic factors that could trigger a sudden spike in volatility.

The related tasks of complying with new rules and putting in place risk management strategies to protect their portfolios against volatility has consumed significant time and attention for senior leadership of Europe’s institutions. But institutions now have been working on these issues the past several years—in many cases with expert advice from asset managers. “By 2017, many of Europe’s largest institutions have made enough progress in these areas to focus on their next pressing issue: diversifying their portfolios to find new sources of investment returns in an era of historically low interest rates,” says Markus Ohlig.

An investment professional for a Norwegian corporate pension fund summed up the perspective of many of the institutions in the study. “Regulations and increased market volatility are issues that take much of our attention these days, as is the historically low interest-rate level and our expectations for it to come up soon. To address these issues, we are looking at alternatives to improve our fixed-income yield. We have already moved our fixed-income assets into global high-yield bonds for the most part, and we are looking more closely at emerging market debt and loans.”

Diversifying Portfolios to Meet Targets

A similar pattern is playing out across the European market: Institutions recognize the need to diversify their portfolios to meet return targets. However, these ambitions are challenged by regulatory and risk management constraints that limit the amount they can invest in asset classes seen as having higher return potential. Nevertheless, institutions are finding opportunities to shift assets into “higher octane” asset classes. While those asset classes include equities and real assets, many of the biggest shifts are occurring within fixed-income portfolios, where institutions are moving from domestic and European government bonds into “specialty” strategies, such as high-yield bonds and emerging markets debt.

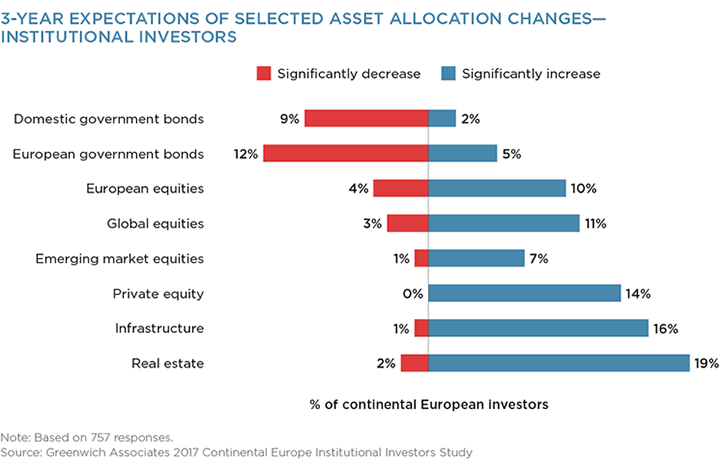

Over the next three years, assets are expected to continue flowing into these specialist fixed-income categories, as well as into private equity, infrastructure and real estate. Institutions expect inflows to hedge funds to be much more modest. “While hedge funds have fallen short of expectations performance-wise, institutions now have access to multiasset funds that perform some of the same functions as a global macro hedge fund strategy—but without the ‘two and twenty’ price tag,” says Greenwich Associates consultant Mark Buckley.

As institutions diversify away from domestic and European government bonds, they are moving further from the comfort area of internal investment professionals. The share of European institutions describing themselves as “expert and well resourced” to manage their investments has been declining for the past two years. Meanwhile, the share of institutions saying they are reliant on external advice climbed over the past 12 months. “Institutions’ reliance on external expertise has created a window of opportunity for asset managers like AllianzGI that are stepping up with advice and solutions,” says Markus Ohlig.

Consultants Mark Buckley and Markus Ohlig advise on the investment management market in Continental Europe.

MethodologyDuring the first quarter of 2017, Greenwich Associates conducted in-depth interviews with 757 key decision-makers at the largest Continental European institutional investors. Institutions included Continental European corporate, public, and industry-wide defined-benefit, defined-contribution and hybrid pension funds, banks (including Sparkassen in Germany), foundations and churches, insurance and reinsurance companies, sovereign pension reserve funds, and other non-pension institutional investors including official institutions, central banks, monetary authorities, sovereign wealth funds, and supranationals.