Commodity trade finance represents a $134 billion1 annual global industry. Traditionally, this business has been funded by banks. But Basel III capital reserve requirements, other new regulations and associated balance sheet constraints have caused banks from Europe and the United States to reduce their exposures to trade finance. The resulting exit of capital has created a new window of opportunity for institutional investors.

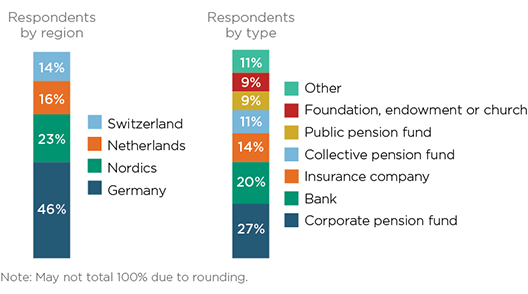

To assess this opportunity and quantify potential demand for this new asset class among institutions in Europe, Greenwich Associates conducted a special study of 56 decision-makers at institutions in Germany, the Nordics, the Netherlands, and Switzerland. These included corporate, public and collective pension funds, banks, insurance companies, endowments, and churches. Interviews were conducted in Q2 2017, and participants were chosen from a universe of institutions with a demonstrated affinity for credit products.

The study was conducted on behalf of EFA Group, an independent asset manager specializing in private debt strategies, with a focus on real-economy business, including trade finance.

1Burroughs, Callum. “TXF Data Update: Structured Commodity Finance Makes a Comeback.” Txfnews.com, 31 March 2017.

MethodologyDuring Q2 2017, Greenwich Associates conducted telephone interviews with 56 key decision-makers at European institutional investors to understand their knowledge and interest in commodity trade finance as an investible asset class.