Allocations to exchange-traded funds by institutions currently investing in ETFs increased by 50% in 2018, totaling 15% of total assets among the 127 institutional investors participating in Greenwich Associates most recent European Exchange-Traded Funds Study. That growth was driven in large part by three key trends:

- ETFs thrive in volatility: European institutions in 2018 were repositioning their portfolios for a turbulent investment environment featuring the prospect of European Central Bank (ECB) rate hikes and a host of geopolitical risks. The implementation of these changes increased demand for ETFs. Institutions say ETFs’ speed of execution, single-trade diversification, liquidity, and other characteristics make them versatile tools for portfolio construction.

- Index revolution: European institutions in search of low-cost beta continued shifting assets from active management to index strategies last year. As they did so, many used ETFs as their preferred vehicle for index exposures. This trend will likely continue in 2019, since institutions’ allocations to index strategies still fall well short of what they consider optimal levels.

- ESG is key: European institutions are integrating Environmental, Social and Governance (ESG) standards into their investment process, and many of these investors are using ETFs as their vehicle of choice for ESG exposures. Forty-four percent of study participants overall and half the investment managers are using ETFs as a main vehicle to address ESG.

These trends helped fuel robust growth in ETF allocations among the institutional funds, asset managers, insurance companies, and discretionary wealth managers participating in the 2018 study. That growth seems poised to continue in 2019, since nearly 40% of existing ETF investors in the research sample are planning to increase their ETF allocations in the coming 12 months.

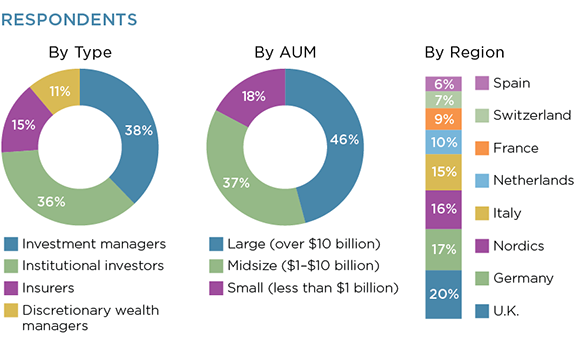

MethodologyBetween October and December 2018, Greenwich Associates interviewed 127 institutional investors for its fifth annual edition of the European Exchange-Traded Funds Study. The research universe includes 46 institutional funds, 48 asset managers, 14 insurance companies/ insurance company asset managers, and 19 discretionary wealth managers. Most of the institutional funds are corporate pension funds (21) and public pension funds (10), although the group also includes representation from endowments, foundations, sovereign wealth funds, and family offices.

Most of the participants are large institutions. Forty-four percent of the institutions in the study have assets under management (AUM) of more than $10 billion, and more than half manage in excess of $5 billion. Respondents represent a wide range of countries, including France, Germany, Italy, the Netherlands, Nordics, Spain, Switzerland, and the United Kingdom.

A large majority of study respondents (92) are portfolio managers and/ or Chief Investment Officers. Twenty-three are research analysts, six are traders and six are in product development, sales or marketing.