Table of Contents

U.K. pension funds continue to search for answers to their ongoing underfunding problem, and asset management firms are stepping up to help. The 2015 Greenwich Leaders in U.K. Institutional Investment Management Service Quality are demonstrating how investment managers can distinguish themselves from competitors by going beyond product provision and supplying corporate and local authority pension funds with counsel and broader perspectives.

Service Quality Leaders

Baillie Gifford, Insight Investment and Majedie Asset Management have one thing in common: They have all made client service a top organizational priority and used their best-in-class service capabilities to help clients address their strategic issues.

Baillie Gifford, which offers global equity, fixed income and diversified strategies focused on growth, is a limited partnership with a long-held reputation for world-class service delivered by high-caliber, long-tenured professionals. Insight Investment is one of the world’s premier providers of the liability-driven investment (LDI) solutions now being employed by many U.K. corporate plan sponsors to reduce their exposure to risks associated with defined-benefit (DB) pension schemes. Majedie Asset Management is an independent investment boutique that actively manages equities for institutional investors, wealth managers and endowments across a range of U.K. and global strategies. The firm is particularly notable for its success in leveraging its internal intellectual capital to provide analysis and ideas to clients through compelling thought leadership and advisory initiatives, often covering topics extending beyond the scope of the investment strategies offered by the firm.

“At a time when pension funds are struggling to achieve the most fundamental goal of funding future obligations to their members, asset management client service can go far beyond providing a positive working experience for the institutions that purchase their products,” says Greenwich Associates consultant Lydia Vitalis. “These Greenwich Leaders are employing a new, higher level of client service that is providing real value to these institutions and deepening the firms’ client relationships.”

Funding Pressures

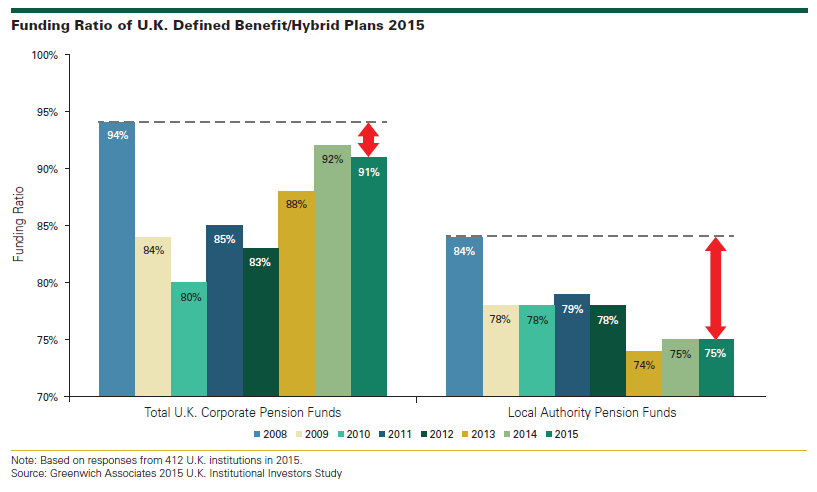

Both corporate and local authority plan sponsors remain hungry for new solutions to the serious problems facing their DB schemes. It is not news that longer term many U.K. companies remain determined to exit the DB pension business entirely. About 80% of large companies have already closed their DB pension funds to new employees or plan to do so in the next two years. The share of large corporate DB pension funds closed to future accruals has climbed to 41% in 2015 from just 31% in 2012. Another 8% of corporate plan sponsors tell Greenwich Associates they plan to close their plans to future accruals in the next two to three years.

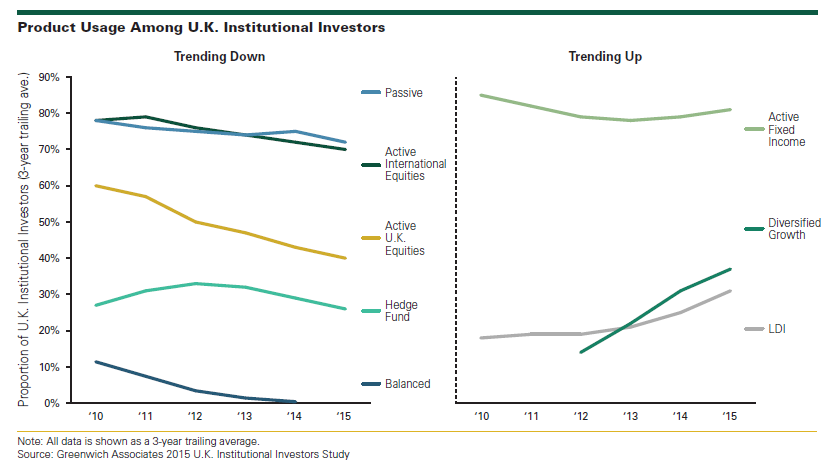

Corporate plan sponsors are also taking aggressive steps within their portfolios to isolate themselves from funding risk associated with their DB plans. As much as 20% of corporate pension assets are now invested in LDI strategies, both pooled and segregated. Corporate plan sponsorscontinue to reduce risk budget spending on active equities, with U.K. active equities accounting for less than 5% of overall assets. “Driven by the structural need to focus on liabilities, we expect allocations to LDI strategies to increase regardless of interest rate movements,” says Lydia Vitalis. “Plan sponsors have been waiting for an uptick in rates to make LDI implementation more affordable, but after five years many funds—at the urging of their consultants in numerous cases—are planning to move forward even if rates don’t budge.”

The rotation from equities is currently focused on international allocations, with 22% of corporate funds planning to make meaningful reductions to active international equity allocations in the next three years. With corporate funds divided in their expectations for active fixed-income allocations, pooled LDI stands out as the most significant beneficiary of the rotation, with about one-quarter of corporate pensions expecting to “significantly” increase allocations to pooled LDI funds in the same period.

Local authorities share corporate plans’ funding problems, and in fact, on average they are in a much worse state. But local authorities mostly lack the ability to close plans to future accruals and even to new employees. Average funding ratios for local authority pension plans held steady from 2014–2015, but did so at an already problematic 75%. In the absence of a fundamental reorganization of pension rights and with little hope of stepped-up cash contributions from hard-pressed municipalities, local authority pension funds are relying on market returns to close those funding gaps. Although equity allocations are on the decline, equities still represent 56% of total local authority pension assets, compared to roughly one-quarter of total assets among corporates. Local authority funds allocate 6% of total assets to alternatives and 4% to multi-asset funds, which are also being adopted by growing numbers of U.K. pension funds as a growth asset. Further reductions in active equity allocations are anticipated to fund allocations to diversify return drivers.

Consultants Marc Haynes and Lydia Vitalis advise on the investment management market in the United Kingdom.

MethodologyBetween February and May 2015, Greenwich Associates conducted interviews with 412 of the largest institutional funds in the United Kingdom. Institutions included corporate funds, local authorities and other institutional funds. Interview participants were asked about their investment service providers, their business practices and their future expectations.

© 2015 Greenwich Associates, LLC. Javelin Research & Strategy is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.