Table of Contents

Insight Investment is the 2017 Greenwich Quality Leader℠ in U.K. Institutional Investment Management Service. Insight received market-leading rankings on multiple key service success factors and is the clear overall market leader.

“Insight Investment is the sole winner for 2017, and Baillie Gifford and Majedie Asset Management also deserve recognition for the distinguished level of service they deliver to their institutional clients,” says Greenwich Associates consultant Mark Buckley.

U.K. Institutional Market Dynamics

Pension funds in the United Kingdom face a challenging future. Average funding levels now stand at 90%, and the share of U.K. pension funds reporting negative cash flows climbed from 40% in 2016 to 50% this year. Investors are banking on significant levels of investment performance to overcome these challenges. In 2015, alpha expectations averaged 82 basis points for corporate pensions and 113 bps for local authority schemes—these have risen to 94 bps and 134 bps, respectively, this year. The percentage of assets allocated to LDI continues to increase and now represents 20% of U.K. institutional assets.

Corporate pensions report that their three main issues are liability management, rate of return and funding issues, and risk management. For local authorities, government regulation, asset allocation and market volatility are the top issues.

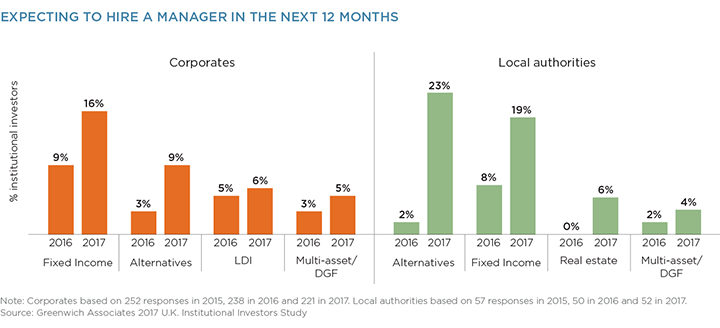

Planned shifts in portfolio allocation to meet these challenges are driving demand for future manager hiring. After a two year decline, 35% of institutional investors expect to hire a manager in the next 12 months, compared to 25% last year. Among corporate funds, demand for new managers over the next 12 months will be strongest in fixed income and alternatives. Local authorities expect an even stronger surge in hiring in those asset classes and in real estate.

While hiring expectations are up, termination rates are up too, at 38%. The increase in terminations is due in part to the shifts in portfolio allocation. However, other issues, not related to a change in investment strategy, account for the majority of the reasons why managers are at risk of termination, intensifying the focus on service excellence.

Pensions Look to Managers for Support

Given this environment, the role that service plays in both retention and as an aid to cross-sales will be critical. Increasingly, the investment managers who will minimize terminations and benefit from increased hiring are those capable of partnering with pension funds as solutions providers rather than product providers. “Firms like Insight Investment are building strong client relationships by coupling investment excellence with top-rated service delivered by client-facing professionals committed to having informed and substantive conversations and delivering expert advice, specific industry and product knowledge, and real solutions to client problems,” says Mark Buckley.

Consultant Mark Buckley advises on the investment management market in the United Kingdom and continental Europe.

MethodologyDuring the first quarter of 2017, Greenwich Associates conducted in-depth interviews with 397 key decision-makers at the largest institutional funds in the United Kingdom. Institutions included U.K. corporate funds, local authorities and other institutional funds, each with over £100 million in total defined-benefit plan assets, defined-contribution plan assets or other institutional assets.