ETFs have taken on a prominent role in the investment portfolios of U.S. registered investment advisors (RIAs), who use the funds in a broad range of tactical and strategic functions.

In this report, we look at the key drivers of ETF growth in these portfolios, including RIAs’ desire to achieve their index exposure through ETFs.

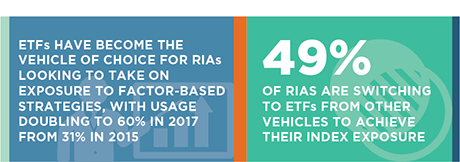

Increased RIA investment in bond ETFs is also behind this growth, as well as reports that RIAs are employing ETFs as their primary means of taking on exposure to increasingly popular factor-based investment strategies. Looking at historic trends in ETF use and allocations, we make projections about the future of RIA ETF investment, which is on track for steady growth ahead.

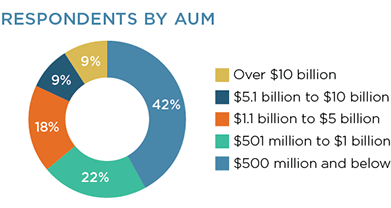

MethodologyBetween October 2017 and February 2018, Greenwich Associates interviewed 57 RIAs as part of its 2017 U.S. Exchange-Traded Funds Study. The majority of the participants in this year’s study have AUM over $500 million, and many have assets above $10 billion.