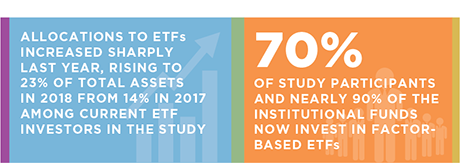

Allocations to exchange-traded funds by current ETF investors increased to 23% of total assets in 2018, up from 14% in 2017, among the 51 institutional ETF investors participating in Greenwich Associates most recent Asian Exchange-Traded Funds Study. This growth was driven by four powerful trends:

- Portfolio Repositioning: A dismal year in Asian equities and a surge in global market volatility forced Asian institutions to reposition portfolios. As they did so, they increased their investments in ETFs, which served as a flexible tool for rapidly implementing tactical adjustments and strategic shifts across asset classes.

- Indexation: The continued shift of assets from active management to index strategies created strong demand for ETFs, the vehicle of choice for index exposures for 9 out of 10 study participants.

- Bond ETF Boom: Investors in bond ETFs increased allocations to the funds last year by over 50% on average, to more than a quarter of total fixed-income assets. Driving this shift was investors’ continued search for a reliable source of fixed-income market liquidity.

- Smart Beta Adoption: Smart beta ETFs are now used by 70% of Asian study participants. A third of those respondents plan additional increases to factor-based ETF allocations in 2019, with a majority of those expecting to boost allocations by more than 10%.

These trends are expected to remain in place and push ETF investment even higher in 2019. We are projecting continued strong growth in the next 12 months not only in fixed income, but also in equities, where nearly half of ETF investors in the 2018 study are planning to expand ETF allocations in the coming year.

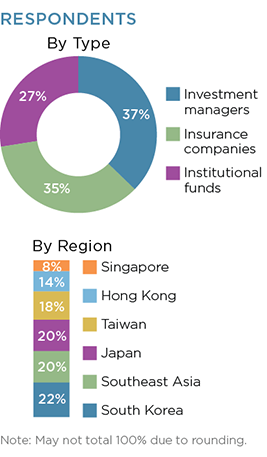

Between October 2018 and January 2019, Greenwich Associates interviewed 51 Asian institutional investors for its 2018 Asian Exchange-Traded Funds Study— the fourth edition of our benchmark annual research program. The research sample, which includes 40 current ETF investors and 11 non-users, is made up of 19 investment managers, 18 insurance companies and 14 institutional funds. Among the institutional funds are corporate defined-benefit and definedcontribution pension plans, public defined-benefit plans, sovereign wealth funds, endowments, foundations, and family offices. Most of the participants are large institutions: 40% have assets under management (AUM) of $10 billion or more.