Our Top trends in asset management for 2025 report noted a “service gap” between traditional (multi-asset class) and specialist asset managers related to client service and client experience. The tremendous growth in private debt, private equity and other alternative asset classes has attracted new competitors from the ranks of traditional asset management. Many of these traditional firms have bountiful resources and customer service baked into their DNA. As they enter these new markets, they are raising the private markets’ service bar. We decided to dig deeper, to understand the specific factors that are driving the service gap between traditional and specialist firms.

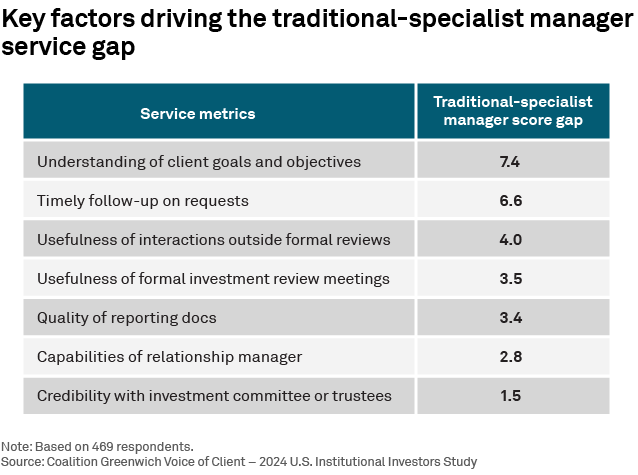

Using data from our 2024 U.S. Institutional Investors Study, we analyzed a series of key service success factors to understand where the differences arise. The following table shows a list of these factors and by how much traditional firms lead specialist firms on these factors:

These are averages across dozens of traditional and specialist firms, and there are, of course, some specialist firms that score highly and traditional firms that score poorly. At an aggregate level, we observe a range of differentials.

Factors with large gaps favoring traditional managers

Traditional firms often take a broad view of investors across a multitude of asset classes and score much higher on “understanding of client goals and objectives.” This is one of investors’ most important service measures and provides firms who excel with an opportunity to develop strategic partnerships.

Traditional firms are also perceived as significantly stronger related to timely follow-up on requests, often a function of resources and robust processes in an environment where over 90% of investors expect a response within 48 hours. “Usefulness of interactions outside formal reviews” is another factor where traditional firms have a significant lead, with many specialist managers now working to engage investors on a more proactive and frequent basis. However, there is still a perception that some specialist managers are predominantly sales-focused and reactive, as one investor noted:

“After the agreement was signed and we entered into a private market investment, there has been very little activity or contact from the (specialist) manager.”

Factors with medium gaps favoring traditional managers

Traditional managers are perceived to be stronger on perceptions of formal investment review meetings, an area with tried and tested approaches, including setting an agenda, inviting the right (and optimal number) of people, meeting regularly in-person, and presenting at the right level for the audience. Traditional managers also have ample opportunity to hone these skills.

Investors have increased their focus on the quality of reporting documents in the past few years, zeroing in on topics such as attribution, access (e.g., portals) and the ability to incorporate data for their own internal purposes. While traditional managers lead at an aggregate level, there is variability across all types of firms, as noted by some large investors:

“Private markets reporting seems to be more variable. Some managers are much better than others.”

“There are managers that are great at providing timely updates, but some provide very little in written format or may only provide written reports twice a year.”

While favoring traditional managers at an aggregate level, investors note that some specialist managers provide more customized and detailed information, reflecting the high variability.

Factors with a more even playing field

Perceptions are less varied at the other end of the scale, where specialist managers are perceived to be closer to traditional managers related to the capabilities of relationship managers (RMs) and credibility with investment committee or trustees. The later point is influenced by investment capability. There is a view that specialist managers have RMs with greater knowledge and understanding of the offerings, as noted by the following investors:

“I would say you tend to get people with greater specialization who are closer to the underlying investments.”

“You tend to have high-quality people in private markets with significant education levels and backgrounds, and usually they know/understand the product and everything that goes into the trading. They understand what the actual portfolio is doing.”

A movement of RM talent toward specialist firms has also been noticed:

“I think there's been a talent drain from public markets into private markets. A lot of the stronger people are ending up there over the past few years. Client relationship people have been going really above and beyond.”

Conclusion

Investors’ service expectations continue to ratchet up, and many asset managers continue to work to deliver a higher value client experience. As some specialist firms work to close the service gap, service perceptions of individual managers (both traditional and specialist) will continue to vary considerably.

Asset managers who understand how they are perceived on service factors relative to competitors, and who take action to hone perceived strengths and close service gaps, will significantly enhance their prospects for sales, cross sales and client retention.