Asia’s fund distribution landscape is undergoing meaningful change, with bank distributors continuing to play a central role even as investor preferences evolve. In most markets where offshore funds are sold, banks account for over 50% of fund sales, making them the dominant channel for asset managers looking to reach retail and private wealth clients.

In the current environment of geopolitical uncertainty and market volatility, investor priorities are shifting. Wealth preservation and risk mitigation have become top of mind, with clients increasingly seeking products that offer stability and diversification. This has fueled demand for multi-asset strategies, which remain a popular choice across the region. These funds’ ability to adapt to changing market conditions and balance risk across asset classes makes them particularly attractive to investors seeking more resilient portfolios.

At the same time, expectations around service quality are rising. In such uncertain times, clients place greater importance on guidance and trust —making the role of relationship managers and advisors more crucial than ever. Asset managers that can support their distribution partners with education, timely insights and strong after-sales service will be better positioned to deepen engagement.

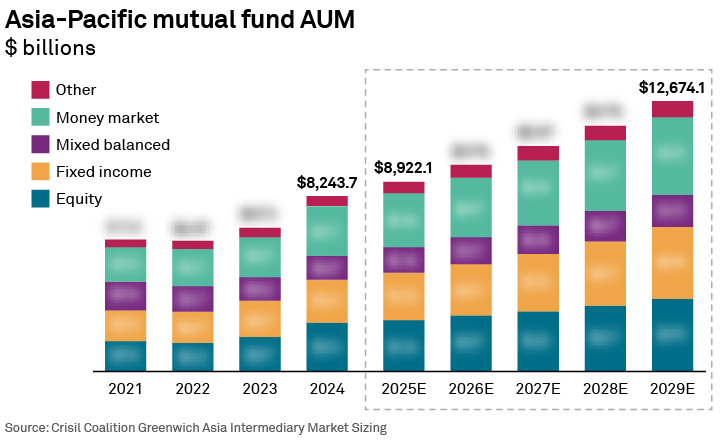

Looking ahead, fund assets in the region are expected to grow by 8.2% this year. While traditional products like equity and fixed-income funds will see modest growth, a significant area of momentum lies in private market offerings. The appetite for alternative strategies is expanding, particularly among high-net-worth clients served through private bank channels.

Private equity and private debt strategies are emerging as key areas of interest. Distributors are showing a clear preference for these products, which are increasingly being positioned as core components of client portfolios. The range of offerings within these alternative asset types is also broadening, signaling greater confidence among asset managers in the region’s ability to support more sophisticated investment solutions.

As the intermediary distribution space continues to mature, competition for wallet share will intensify. Asset managers need to align more closely with their distribution partners, tailoring offerings and engagement strategies to meet the unique needs of different channels—whether retail banks, private banks or independent financial advisors.

Ultimately, success in Asia’s intermediary landscape will hinge on a combination of product innovation, service excellence and the ability to deliver value across both traditional and alternative investment segments.

Crisil Coalition Greenwich sizes the retail fund markets regularly as part of our Asia Intermediary Market Sizing research, providing data-driven insights into product trends, distributor activity, and competitive positioning.