The extended discussion surrounding the NYSE outage from last Wednesday seems your typical case of rubbernecking. Maybe it's wishful thinking that this event will fit neatly with the Flash Boys script, painting the US equity markets in disarray due to fragmentation and e-trading. But looking at data related to that trading day, it feels like a different story is emerging; one less likely to sell papers but important to the maturation of US equity market structure.

Exchange rates

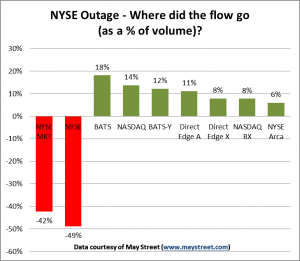

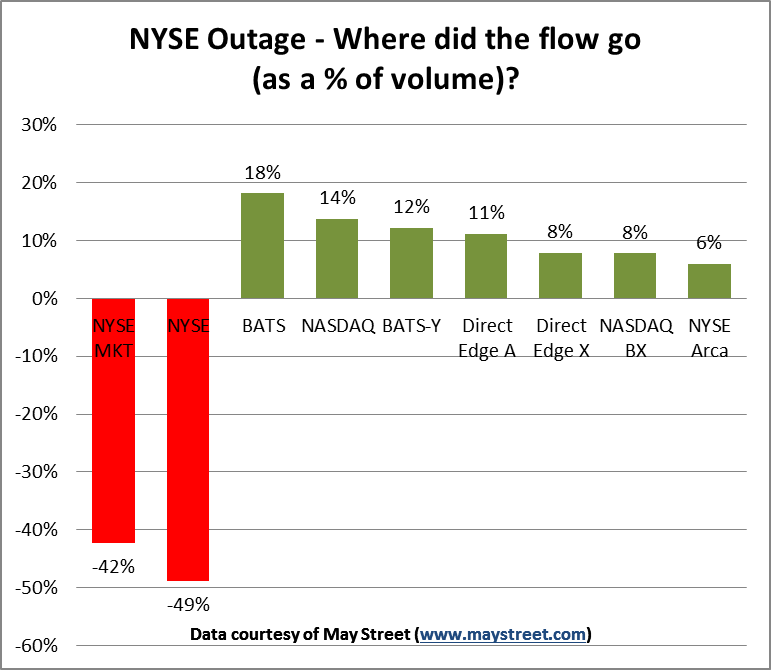

To get a sense of where NYSE’s order flow was reallocated, we compared July 8th volumes to the average trading volumes from both the day before and after the NYSE outage (July 7th and 9th).

As a percentage of flow, the majority of NYSE shares that didn’t trade on the Big Board appear to have been spread across the other major US Exchanges. BATS was the biggest pro rata winner, with an 18% increase on July 8th. The NASDAQ (14%) likely gained the most in terms of total shares since its daily market share jumped from 16% to 18% whereas BATS popped from 7% to 8%.

A few general assumptions could be made from these stats, although little is clear. It’s possible that BATS is slightly favored over NASDAQ as the next best venue to execute NYSE-listed symbols. BATS technology is known to be fast and stable. Also, since it’s not a listing Exchange, market participants who feared contagion due to some greater, malicious act (remember United was having system issues this day too) may have transferred flow to the BATS and Direct Edge exchanges as a hedge.

In terms of the major exchanges, NYSE ARCA gained the least overflow. This could simply be driven by routing configurations already in place. Another possibility is that a handful of brokers blocked routing to the venue out of precaution since it is the third equity exchange in the NYSE family.

Follow the Light

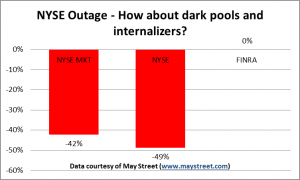

Compared to the major Exchanges, volume printed on FINRA was flat on the day of the outage. This is a clear sign than brokers’ routing technology is configured to reroute order flow to like venues. With the NYSE out of commission, orders were not suddenly shifted to non-display venues nor were they farmed out to wholesalers/market makers. It was an apples-to-apples transference, and heavily scrutinized dark pools essentially played no part in the July 8th events.

Getting Your Fill

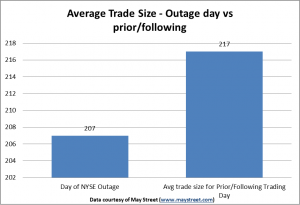

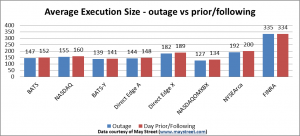

Other than exchange flow rebalancing, other stats from the day look rather normal. For instance, the average execution size across venues was generally inline. For the day of the outage, fill sizes slipped slightly to 207 shares per trade. For the prior and following trading days, the average was 5% larger at 217 shares per trade. This small dip may be attributed to more order flow dispersion in light of the event and slightly less efficiency in order routing.

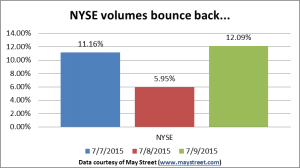

Big Board Bounce

NYSE rapid recovery supports the argument that markets are resilient. The day following the outage, NYSE volumes bounced back with their overall market share for the day slightly higher than prior to the event. This is yet another positive sign that the marketplace is prepared not only to adjust when venues are in distress, but also to revert back when issues are resolved.

From a best execution perspective, brokers certainly need to protect their customers’ interests in abnormal market conditions, but ultimately their obligation is to route to venues that provide quality liquidity. A four hour outage does not change that obligation in a material way.

The portability of flow

A lot has been written about the number of trading venues available in US equities today. Many believe there are too many places to execute an order. Putting that argument to the side for a minute, one of the positive byproducts of so many options is that routing technology has been designed to reallocate order flow dynamically as system issues occur.

In essence, liquidity in the US equity market is now portable. This lowers the risk of an isolated system failure having impact on the entire market. Granted, issues with industry utilities like the SIP (as we saw during the NASDAQ Flash Freeze in August 2013) create massive disruptions in trading, but no individual venue, even the largest US stock exchange, is likely to shut down trading today.

“Close” Call

Certainly, any time a major exchange has an extended outage, we want to know why and what can be done to prevent the same issue again. Reg SCI rules are written to address system integrity and will likely reduce the frequency and severity of outages but not eliminate them completely.

In the case of the NYSE, this incident did generate one important talking point. Many market participants (e.g. mutual funds) generate NAVs from primary exchange closing price auctions. Wednesday’s event highlights the need for all listing exchanges to have alternative means of generating a proper closing price when system issues occur. In this case, the NYSE was up for the open and close. If this issue perpetuated into the close, then price discovery related to the closing price would have impacted.