As investment and regulatory requirements become more complex, insurance companies globally are increasingly turning to external asset managers to help with specific investment strategies and solutions.

In Europe in particular, regulation is driving these opportunities, but also presenting challenges for asset managers. Understanding how regulation impacts insurance companies' asset allocation decisions is key. And asset managers that simply "push" their capabilities to insurance companies will most likely see only moderate success.

Tailoring their investment strategies and their sales approach to the specific needs of insurance companies is a worthwhile effort for asset managers. In continental Europe, insurers represent the largest source of externally managed assets (€1 trillion compared to €900 million from corporate and public pension funds), as reported by institutional investors in the Greenwich Associates 2017 Continental European Institutional Investors Study.

Opportunities in High-Margin Products

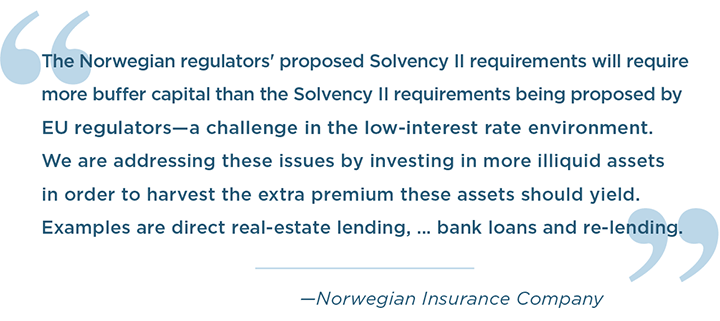

Outsourced assets are shifting toward higher-margin products due to the combined impact of low interest rates and Solvency II, the set of regulations dictating capital adequacy for insurers since January 2016. Compared to other institutional investors—most notably, pension funds—insurance companies have a much greater appetite for bank loans, infrastructure debt and real estate debt.

These three asset classes contain primarily unrated debt, and Solvency II provides insurance companies significant leeway in determining the capital charge required for these investments. If the insurer can credibly demonstrate that the risk profile is, for example, similar to investment-grade corporate debt, it will incur a similar capital charge, but with a significant pickup in yield for the investor.

Asset managers successfully selling these types of strategies have developed a strong set of skills to help insurance companies determine the appropriate capital charge. Needless to say, those asset managers that have built capabilities in these areas are well rewarded for their efforts. Margins are much higher than in traditional, liquid fixed-income investments. Furthermore, they represent "sticky" asset classes, requiring a long-term commitment by the investor.

There are also opportunities for managers focused on traditional liquid asset classes with insurance companies. But in order to succeed, these managers need a good understanding of the capital charges associated with their strategies and, in particular, detailed knowledge of how their strategies correlate with both the asset and liability side of any given insurance client—another key element of the Solvency II regulation.

For a more in-depth look, read my recently released report, Insurers Present Challenges and Opportunities for Asset Managers