The goal of the FX Global Code (FXGC) is to “promote the integrity and effective functioning of the wholesale foreign exchange market.” The FXGC covers topics ranging from operations and workflow to trading and algorithms to risk management. While the FXGC is meant to apply to all market participants, recent Crisil Coalition Greenwich research reveals that corporates have not adopted the code in significant numbers.

The ideas embedded within the Code, such as transparency and disclosure related to execution algorithms and TCA tools, ought to resonate, but some fundamental headwinds to adoption remain. More specifically, a lack of awareness about the code and a perception from corporate liquidity takers that they are not active market participants has limited adoption.

The first hurdle: Awareness of the Code

Many FX trading firms believe strongly in the need for the FXGC and are deeply involved in its evolution and how it responds to market changes and the needs of the FX trading community. Corporations are significant users of FX services and, therefore, should be at least aware of the Code, what it does, and its potential benefits. Yet awareness of the code remains low.

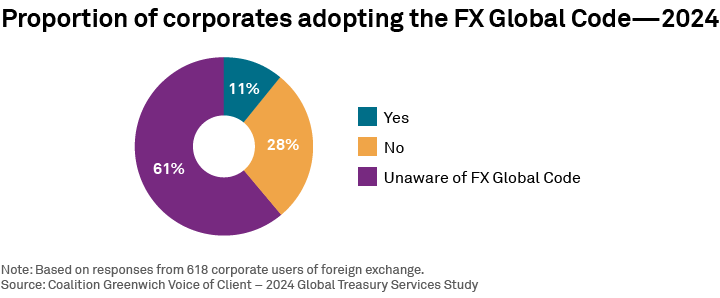

According to our research, 61% of corporates interviewed were unaware of the code. Of the 39% that are aware, nearly three-quarters have still not adopted the code. This suggests that awareness is a significant, but not the sole, hurdle to greater adoption.

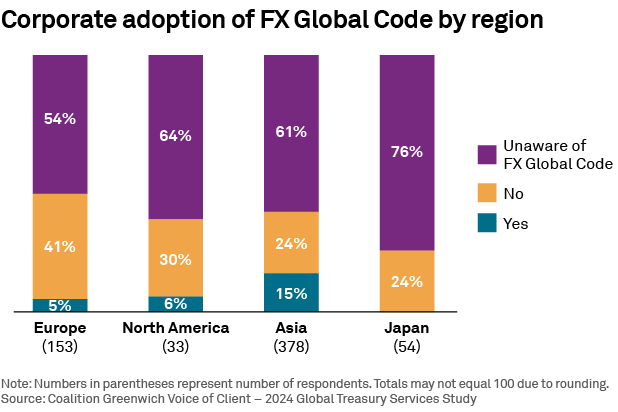

While there are some regional variations to awareness, the overall pattern remains directionally consistent.

Awareness is highest in Europe, followed closely by Asia ex-Japan, and lowest in Japan. A look at adoption reveals a slightly different pattern—it is highest in Asia ex-Japan and essentially equal in the North America and Europe. A closer examination of the data reveals that a diverse range of companies from numerous countries have adopted the FXGC. Notably, a significant trend emerges in Asia, where a disproportionately high number of South Korean companies have signed the Code.

This development presents an opportunity for banks and regulators to draw valuable insights from the experiences of this market. In contrast, European companies are generally aware of the Code but have yet to be convinced of the benefits of adoption. In some cases, it is evident that companies have not fully disseminated their approach to the FXGC throughout their treasury teams, suggesting a need for greater internal awareness and education.

The second hurdle: Applicability of the Code

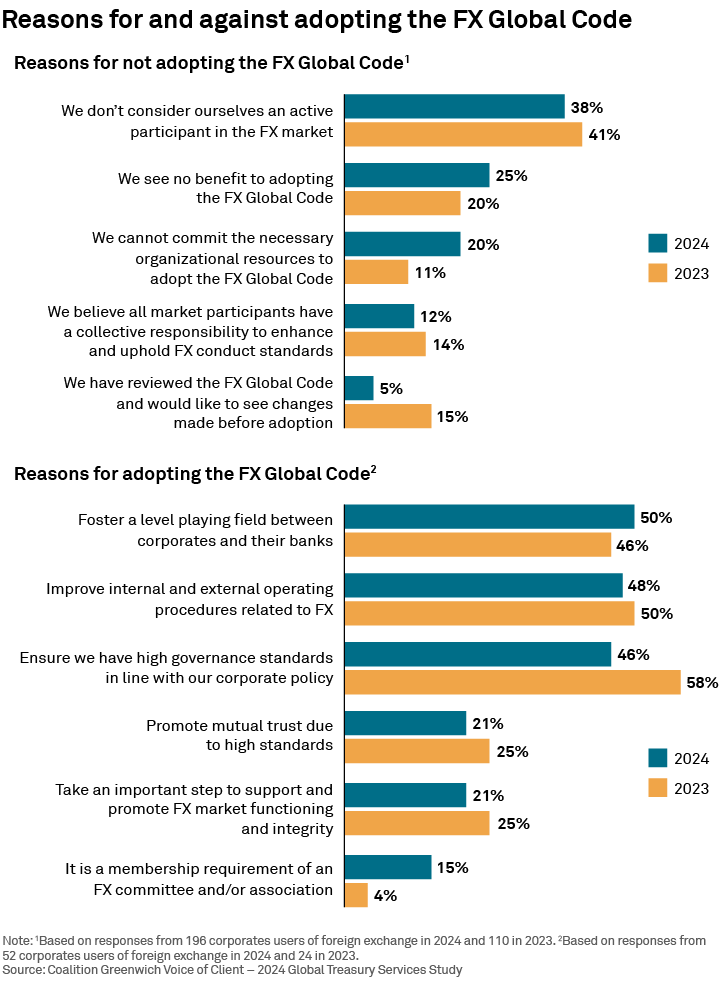

In both 2023 and 2024, the main reason corporates that were aware of the Code did not adopt it was that they did not consider themselves active market participants. They utilize FX markets to manage their business operations rather than as an investor or trader, leaving many to feel the code is not intended for them.

Dealers that depend on FX revenue from corporates—whether straightforward spot trades or more complex FX options—may not agree. Bank relationships with corporations tend to encompass more than just FX, including lending, lines of credit and cash services. Banks sometimes raise the idea of the Code to their corporate clients, but even if this increases awareness, corporates then must consider the best use of their resources.

If a cursory review of the Code doesn’t immediately reveal how it could level the playing field or improve the service levels they receive, corporates may not investigate it further. For some corporates, properly understanding the code would require time and effort from departments ranging from legal to compliance to operations, and they are unwilling to allocate those resources to even perform that initial research. Increasing transparency into algos, one of the goals of the Code, could be provided to corporates without the Code, suggesting they can see the same result with less paperwork.

The Global FX Committee released the latest iteration of the FXGC in December 2024, following a targeted review that confirmed the Code remains largely fit for purpose. The updates focus on two key areas: mitigating settlement risk and enhancing transparency around the use of FX data. These revisions offer significant benefits for corporate FX users.

The new guidance on settlement risk mitigation provides corporates with clear, practical steps to reduce this potential risk, while the enhanced transparency around data usage acknowledges the valuable insights that can be gleaned from trading activity data. Given the prevalence of multi-bank platforms in corporate FX execution, this increased transparency is particularly welcome, enabling corporates to better understand how their data is utilized and make more informed decisions.

Conclusion

The reasons that corporates are not widespread adopters of the code vary, but the first step to changing this is to increase awareness of the Code. The banks will sometimes discuss the Code with the corporate clients, but it does not appear that corporates are focused on the topic, as they see limited upside to adoption.

Unless the ROI of FXGC adoption becomes more apparently to corporate CFOs, inflation, tariffs, interest rates, earnings, and margin will continue to take priority.