In the asset management landscape, creating a superior client journey is paramount for institutional clients. Coalition Greenwich client experience research in 2023 aims to help asset managers define best practices and avoid pitfalls by examining institutional investors’ needs and preferences in each stage of the client journey, from sales and onboarding to client servicing and relationship reviews. This blog captures select highlights from the Coalition Greenwich Voice of Client – 2023 Enhancing the Client Experience Study (North America), offering a glimpse into the broader spectrum of findings on investor preferences and a best-in-class client journey.

Sales: Demonstrating Value Beyond Investments

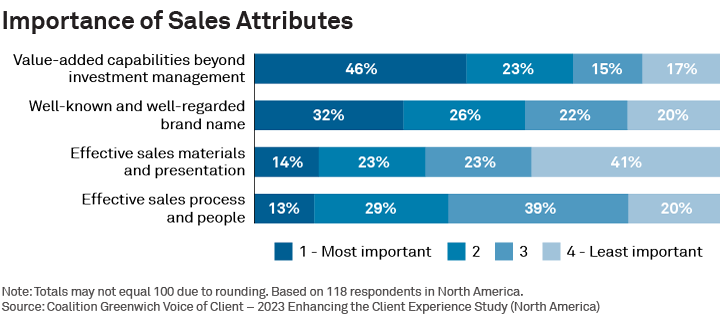

Investors resonate with managers who offer value beyond the scope of traditional investment management. Larger institutions in particular emphasize value-added capabilities, while smaller plans place higher significance on brand recognition. Crafting a compelling narrative around these differentiators becomes crucial in establishing a connection with institutional clients.

Onboarding: Navigating Contract Negotiations and Asset Transition

Delays in the onboarding process often stem from intricate contract negotiations and the complexities of asset transition. Investors consistently highlight the need for improvement through standardization and digitization. Streamlining these aspects not only expedites onboarding but also cultivates an environment of transparency and efficiency.

Servicing: Foundations of a Robust Client Experience

A best-in-class client experience in servicing hinges on a profound understanding of investor goals, coupled with high-quality and timely reporting. Timeliness is a consistent factor across servicing needs: About two-thirds of investors want standard questions or routine issues addressed within 48 hours, while 26% of U.S. investors expect a same-day response. Proactive outreach, deep client knowledge and an agile response to client needs are the principal components that elevate the servicing phase, fostering a partner-like relationship built on trust and collaboration.

Reporting: Unveiling Insights through Preferred Channels

Seventy-three percent of North American investors prefer email as the primary digital means to access reporting, favoring its direct and personalized nature over portals. Performance attribution emerges as the most crucial reporting element for investors, providing them with a comprehensive understanding of their investment's success. Following closely are insights into portfolio positioning, adding depth to the reporting framework.

Conclusion

Mastering the intricacies of the sales process, optimizing onboarding procedures, delivering exemplary service, and tailoring insightful reports are the pillars upon which asset managers can build a client journey that not only meets but exceeds the expectations of institutional investors. By aligning with investor preferences and integrating innovative solutions, asset managers can forge enduring partnerships in an ever-evolving financial landscape.

Sophie Emler and Elizabeth McIvor are the authors of this publication.