The relationship between the buy side and their brokers is often complex, with commission rates being just one aspect of a broader arrangement. These rates are negotiable and depend on a variety of factors, including the firm type, trading volume and complexity, execution quality, platforms used in order routing, and ancillary or bundled services such as research, regions and regulations.

When negotiating commission rates, investors aim to achieve the best possible trading outcomes while controlling costs. While these rates differ vastly, and the landscape ebbs and flows (emphasis on the ebb), one trading contact noted, “Rates are not going up.” Much to the relief of sell-side desks, however, they may be finally leveling off in the U.S.

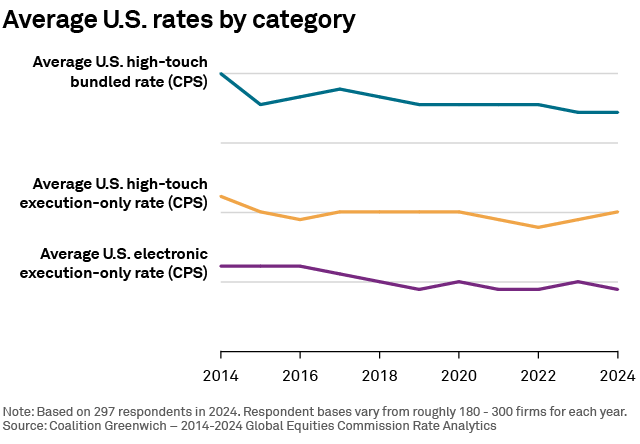

U.S. commission rate trends

In the United States, high-touch bundled rates have trended down over the last 10 years. Bundled rates include both the execution and research spend pieces of a commission rate. The U.S. has the tightest range of commonly set rates. Buy-side desks we spoke with confirm they are seeing this downward trend. While many brokers still fear the “race to zero,” rates have largely remained steady over the past five years.

Buy-side firms report there was pressure from asset owners to lower commissions going into Covid. However, as evidenced in the high-touch execution-only rates, their asset-owner clients have acquiesced and now want to “pay up” for better service, ECM and research. “We don’t want to be the 10th call,” one trader noted. The buy side wants their rates to be in line with their peers, but not the lowest, recognizing that they need to pay for better coverage and more information.

U.S. low-touch execution-only rates have similarly leveled off but exhibit more year-over-year variability than high-touch. This may be due, in part, to hedge funds focused on “rock-bottom rates” successfully negotiating lower rates due to increased trading activity. Long-only managers tend to be more consistent with pricing, with one trader noting they can’t have rates “sticking out higher or lower.” The reason is simple: “Compliance asks, why?”

Either way, today’s asset managers (and their asset-owner clients) seem to have a better understanding of their brokers’ execution and operational costs. Brokers note a concerted effort from both sides in maintaining their existing relationships. They suggest the buy side understands that they can “only cut so far,” while brokers themselves need to view their relationships more holistically across other services, being open to lower rates when necessary to defend meaningful business. However, the math is not in the brokers’ favor, as their own execution costs (including venue access fees, connectivity and market data) are only increasing, as shown in previous research.

Partially due to their ever-increasing costs, one buy-side trader suggested bank-based brokers need to accept that “electronic desks won’t be a meaningful profit center in the future.”

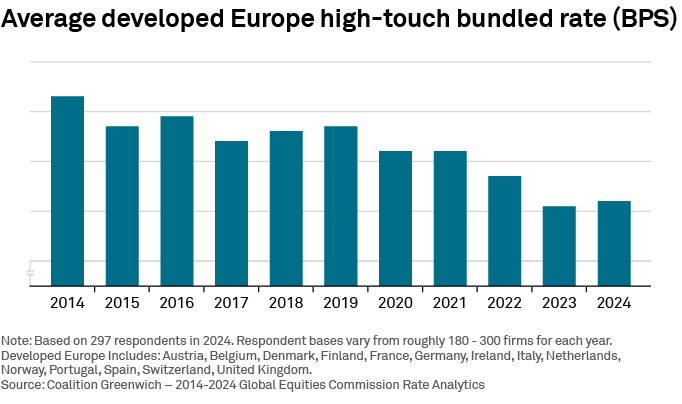

Developed Europe commission rate trends

Europe has a similar trend line to U.S. high-touch bundled rates and similarly tends to have lower commission rates paid year after year. We did see an interesting change in 2024, with this year’s average being 1% above last year’s. There have been upticks like this before for developed Europe, but not for five years. Coming off a historical low, it’s unlikely that European rates will continue to trend north; rather they should stabilize as what they need to pay across the continent becomes more clear.

Developed Europe rates dropped approximately 3% in 2020. While not surprising alone, we see opposing stories when compared to the 2020 year-over-year rates in the U.S., where rates were more consistent with the rest of the world. International markets are becoming more efficient in terms of commissions clarity, while U.S. rates have already declined and are more stable in comparison.

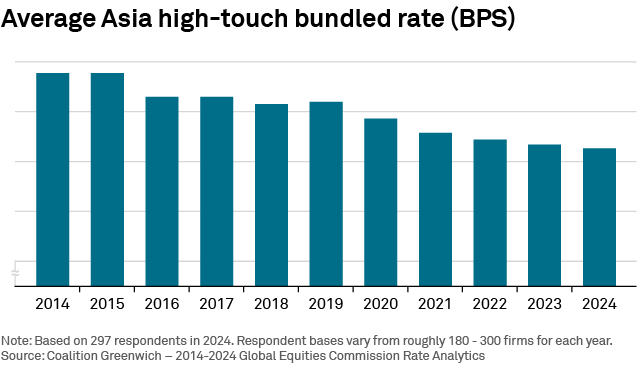

Asia commission rate trends

In Asia, we see our most consistent negative trend line so far. In 2024, high-touch bundled rates declined 28% from the 2014–2015 highs. Liquidity and interest in these markets continues to increase inversely to the graph below. Commission rates in Asia have been consistently higher than those in Europe, but the gap has been narrowing as rates decrease across both regions.

We also saw a similar dip in rates in 2020 to that in Europe. This can be attributed to buy-side firms becoming more price cautious during the pandemic or sell-side dealers being open to lower rates to drive business across the two continents.

Conclusion

This exercise reveals a clear decline in commission rates across regions and trading categories. While this may be the macro view from my desk, the intricacies and independence of criteria prove that this should be analyzed on a micro level for anyone interested in true optimization.

From our discussions with buy-side heads of trading and data professionals, the largest determining factor of the rates they pay is the peer group that they are a part of. This is why we break down these rates in greater granularity in our overall study Coalition Greenwich - 2024 Global Equities Commission Rate Analytics. Our annual report is available to select participants in our research. In the study, we provide analysis for rates based on AUM, commission spend and region of the responding firm.

Buy-side research associate Dylan Gagne is the author of this blog.