Our conversations with dealers over the past few months have left us wondering if volume weighted market share is the right metric for gauging success in fixed income dealing. In past years market share always brought with it bragging rights, both externally with clients and peers and internally with the bonus committee. As such, rankings were important and their relevance never questions.

Things have changed over the past few years however, with dealers now much more focused on revenues and profits than on their place in the market share tables. This makes intuitive sense - why spend more time on a high volume client who brings in the same revenue as a lower volume (and hence lower maintenance) one just because they increase your market share rankings?

In an effort to determine the importance of market share in today's world, we set out to examine the relationship between market share and revenue. The result: market share still matters.

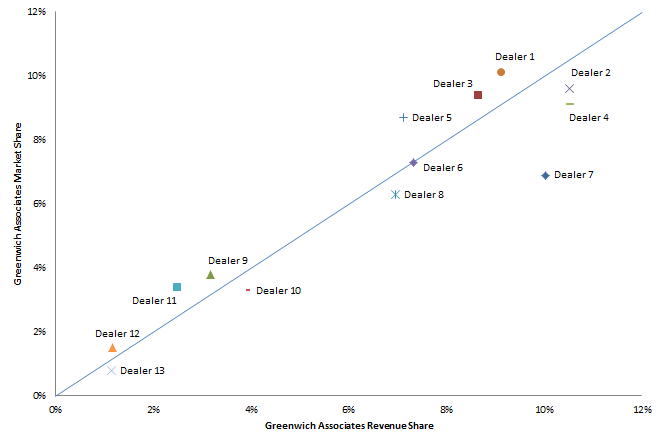

Revenue and market share are tightly correlated for the top 10 fixed income dealers globally (see chart below), which means the more volume you handle the more money you make. But as with all things financial markets, there is more to it than that.

Our analysis also found that there is such a thing as higher value client flow. Assuming the correlation we've calculated is accurate (which of course we do), those firms below the line have revenues that surpass their market share. This tell us that each trade these firms execute is making them more money than their peers. The opposite is true for those firms above the line.

(Note: We can provide some insight into who's who on the chart below for Greenwich Associates clients - just email me).

Examining a sell side fixed income business as a single thing can be tricky. We examine 16 different product types within our annual fixed income study for example, each of which has very different dynamics, regulatory pressures and client demand. And not every major bank is big in every one of those products. Nevertheless, across the several scenarios we analyzed the correlation between market share and revenue held tight. The bottom line: market share is about more than bragging rights.

Market Share vs Revenue Share

Market Share vs Revenue Share

Source: Greenwich Associates