Corporate foreign exchange users consider both execution and a bank’s ability to deliver a seamless service across products and channels as vital components of a successful relationship with their banks, according to the latest Coalition Greenwich Corporate Treasury Study on Foreign Exchange Services. The findings are based on interviews conducted with globally based corporate FX users in 2022.

Looking Beyond Execution Capabilities

Voice execution and electronic capabilities together account for nearly 50% of the value-add provided by dealers to corporate FX users. However, corporates continue to consider their sales relationship an important driver of the value delivered by their banks. And, while efficiency in back-office operations may not help banks win new business, any lapse can lead to a loss of clients. Corporates continue to value banks’ research to inform their hedging decisions.

Integrated Banking Platforms vs. Stand-Alone FX Service

When it comes to trading volume allocations, corporates are not looking at FX services in isolation. Rather, over half their business is driven by a bank’s cash management and trade finance offering and lending book size. Hence, based on a corporate’s needs, banks need to strike a balance between selling their FX stand-alone execution platform versus offering an integrated digital banking solution with an FX component.

Multidealer Electronic Platforms Hold Sway

Electronic trading still accounts for two-thirds of corporates’ FX trading volumes. However, the volatility seen in the FX market, especially in the first half of 2022 following Russia’s invasion of Ukraine, ensured that the share of voice barely fell. Dealer relationships—and voice trading—come to the fore during times of volatility.

Corporate FX users also prefer to execute FX trades on multidealer platforms rather than via bilateral channels (single-dealer platforms and APIs). This stands in marked contrast to institutional users who are very willing to use bilateral execution channels. While corporates are not interested in single-bank FX platforms, they are keen for their banks’ holistic digital platform to provide tight integration across all products including FX. In other words, they want a one-stop shop, not multiple specialist platforms.

The explicit and implicit costs associated with offering liquidity on these platforms mean banks struggle to monetize the flows they see. Hence, the most innovative banks are looking at new ways of interacting with their clients—for automating operations like hedging and by integrating FX into cash management and lending products, thus reducing the corporate clients’ operational risk and workload.

Europe Drives ESG Allocations

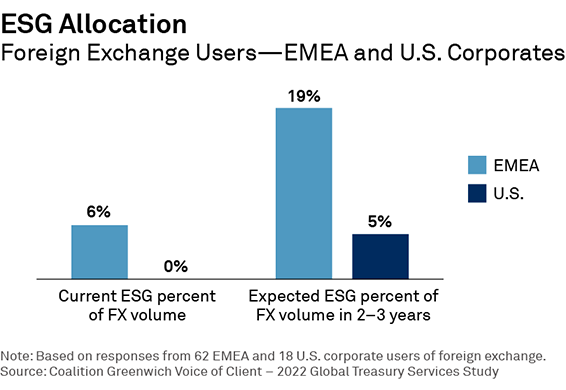

The share of ESG allocations in FX volumes is expected to rise from 4% currently to 10% in three years. Europe will continue to take the lead here, given the lower prominence of ESG in the U.S. Moreover, regulatory action, such as the EU’s border emissions trading regime, will force greater focus on ESG across the full stack of business operations.

Corporates who wish to share their perceptions in the Corporate Finance Study on FX can do so by reaching out to us at contactus@greenwich.com. In recognition for sharing their perspective, participants will receive access to the Greenwich Exchange, an experience and source for connecting financial professionals to industry insights. This access includes robust, trended and actionable data to inform decision-making and enhance relationships with bank providers.

In Q1 2024, Coalition Greenwich will also announce the Greenwich Leaders recognized by their corporate clients for superior quality in FX services.

Tom Jacques is the author of this publication.