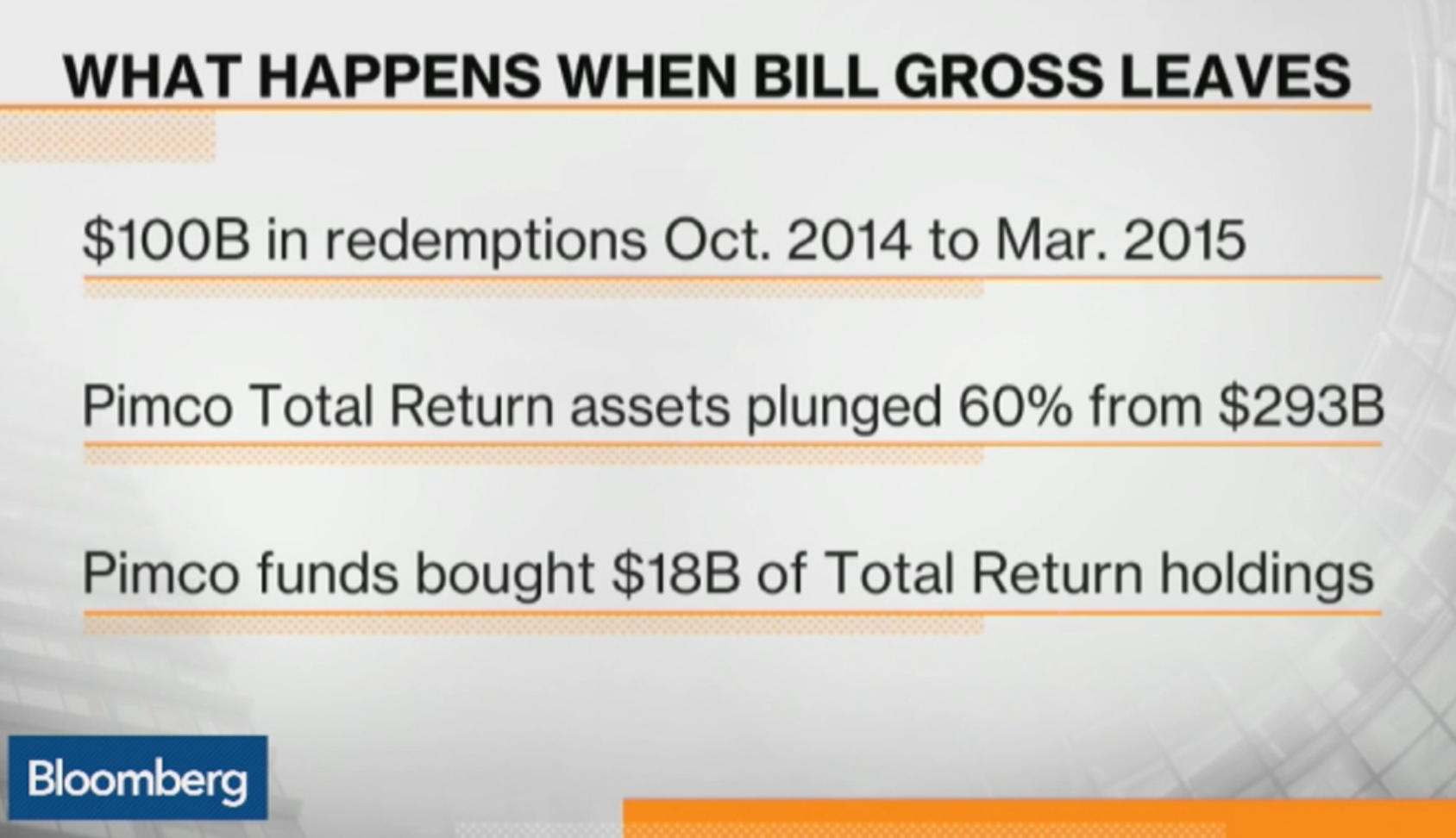

When Bill Gross left PIMCO many in the market were concerned that the expected outflows would crush bond prices as they were forced to sell. This turned out to not be the case, and we shouldn’t really be surprised. Major market participants like PIMCO have plans to deal with unexpected shocks and redemptions, and this was a great example of an asset manager putting those plans into action. Here’s my conversation with the folks at Bloomberg News:

http://www.bloomberg.com/news/videos/2015-06-11/how-pimco-mitigated-the-loss-of-bill-gross