Table of Contents

“This is a big year for uncleared margin,” a poignant statement from ISDA CEO Scott O’Malia in his recent conversation with Coalition Greenwich. The next phases—5 and 6—to be implemented on September 1, 2021 and September 1, 2022 respectively, will bring into scope many asset managers who, thus far, have not been subject to the initial margin (Reg IM) rules.

What makes 2021 a big year is the scale of the impact. Asset managers (according to ISDA roughly 1,000 affected over the next two phases) and, frankly, the industry overall, must develop comprehensive strategies to accommodate the changes wrought by uncleared margin rules (UMR). This is because UMR will change much of the collateral process, from calculation to safekeeping of collateral to eligibility criteria, and more.

Two of the many challenges discussed include the documentation requirements, and the operational and technology impacts.

Documentation

Although asset managers may be used to IA (independent amount, which is the legacy method), Reg IM is the new standard. To continue trading, therefore, an asset manager and their broker must agree to and implement new Regulatory IM Credit Support Annexes (CSAs) before the asset manager’s regulatory deadline. While there is a lot of standardization to these documents, the negotiations may be time consuming, adding to the burden of legal departments.

The documentation challenges don’t end there. Not only must asset managers agree to a new regulatory CSA with their counterparty, they also need to think about the segregation aspects of Reg IM. The new rules dictate that IM be exchanged bilaterally, meaning each party must post to each other. When an asset manager is pledging Reg IM, it must be held at an independent third-party custodian—new agreements must therefore be accepted by the asset manager, the broker and the custodian. Custodians will face an onslaught of requests to paper and open these accounts, so asset managers need to act well ahead of the compliance date. During other phases, trading relationships had been suspended when custodial arrangements were not yet in place.

Operations and Technology

From a calculation perspective, regulators want to ensure sufficient IM is exchanged. To do so, many asset managers will use ISDA’s Standard Initial Margin Model (SIMM) to calculate the amount. The inputs and math to generate a SIMM calculation are generally more complex than we see for IA, so asset managers have to enhance their data acquisition processes, as well as determine how technologically they will calculate SIMM. Both the data and calculation requirements mandate an evaluation and rethinking of the technology used by an asset manager.

In addition, because regulations dictate that brokers pledge Reg IM to asset managers, the brokers may decide to place their Reg IM with a tri-party agent. The buy side or the buy side’s service provider must therefore consider how they will connect to the tri-party agents to confirm collateral value and eligibility. You can’t determine if your broker has sent sufficient collateral if you can’t connect to the collateral location.

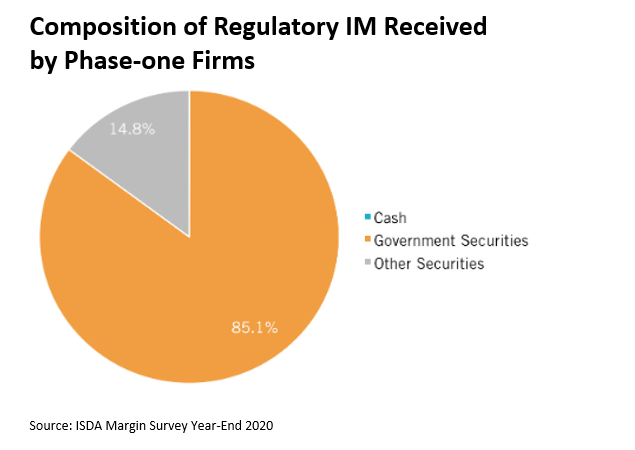

What collateral can be pledged also changing. The chart below from the ISDA Margin Survey Year End 2020 shows the composition of Reg IM for Phase-one firms. Not surprisingly, government securities make up a majority of the total.

Looking Ahead

All the complexity cited above will lead to a variety of changes to market. For example, we expect firms to actively monitor their Average Aggregate Notional Amount (AANA) and IM thresholds to ensure they, to the extent practicable, stay under the trigger amount, or at a minimum, have time to prepare for compliance.

In addition, portfolio managers may modify their trading strategy, moving from pure bilateral to either central-cleared swaps or exchange-traded derivatives. As more securities are pledged as collateral, the need to optimize the trading strategy and collateral selection process increases—that too is a data and technology challenge. The positive news is that there are a lot of solutions emerging: Technology vendors are partnering, market utilities are finding a valuable role for themselves, and execution venues are readying new instruments.

Get ready, there is indeed a lot of work to be done.

[1] Source: ISDA Margin Survey Year-End 2020