One of the more exciting trends we have observed within the continental European institutional investment community in recent years is the heightened interest in and flows to infrastructure strategies. In our latest annual report on the leading trends in the regional market, deepening interest in private markets is one of the more important takeaways. Within this broad trend, infrastructure emerges as the real “Belle of the Ball.”

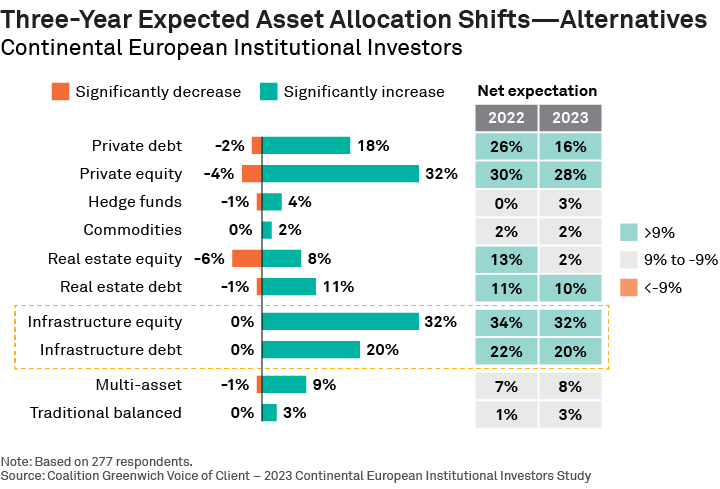

During our 2023 research with continental European institutional investors, we asked nearly 450 decision-makers about their planned target allocation shifts over a three-year horizon. A significant proportion said that they plan to increase infrastructure allocations (both equity and debt).

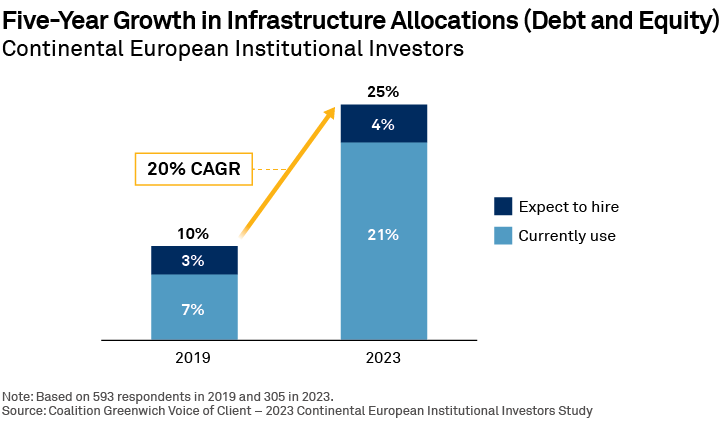

Perhaps even more impressive, when we asked investors about their current use and immediate hiring expectations over a one-year horizon, the data shows remarkable growth in interest over the past five years. In fact, our research projects that infrastructure equity mandates will be most in demand in 2024, tied with private equity.

Broad Benefits of Infrastructure Investing

So why this recent surge of interest? The benefits of infrastructure investing are well known: Infrastructure investments tend to weather inflation and market-cycle volatility over the long-term, they provide relatively predictable cashflows, and they are inherently linked to broader economic growth. More recently, the direct link between infrastructure and sustainability is also becoming more evident and valuable to investors.

Wanting to learn more about the specific dynamics drawing institutions closer to infrastructure, I connected with Nicolas Moriceau, Director of Investor Relations at Infranity, a €9bn Paris-based manager specializing in both infrastructure debt and equity.

Given the broad benefits of infrastructure investments, continued European focus on sustainable infrastructure development projects, and our general positioning in the economic cycle, one could project infrastructure debt and equity allocations to hold strong and become even more central elements of institutional portfolios in the years ahead.

If this topic interests you, please get in touch, as we are currently conducting a global, deep-dive research initiative into infrastructure investing with results expected later in the year.

Christopher Dunn is the author of this publication, with Alastair Brown contributing.