Table of Contents

Over the past several years, there has been growing interest among institutional investors in environmental, social and governance (ESG) investing. In fact, ESG is possibly the most talked about topic in our recent conversations with investors, consultants and managers.

But with much of the current ESG activity focused across the pond, our clients often ask about the state of affairs in North America. Why are we behind the curve? Will ESG ever take hold in earnest here as it has in Europe? Is there actually a returns-for-impact trade-off?

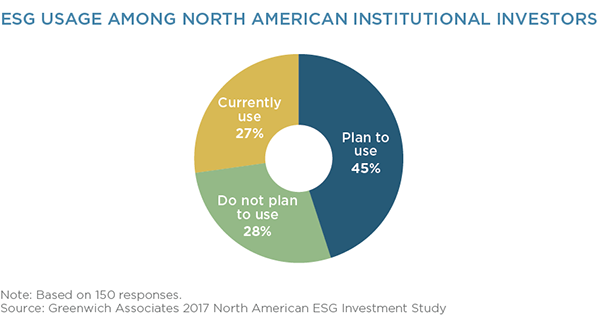

Seeking answers, we went to the marketplace, conducting in-depth interviews with 150 North American institutional investors to better understand their attitudes toward ESG and their likelihood of integrating ESG principles into their investment strategies.

Growing Demand for ESG

To be clear, most institutional investors in North America have not adopted ESG strategies in a meaningful way, and many never will. As reflected in our study, only 27% of institutions reported applying some degree of ESG standard to their overall portfolio.

What’s more interesting is the 45% that are considering incorporating some form of ESG practices in the future. That forecasts a seismic shift in attitude toward ESG and likely signals a wave of fresh demand.

The Path to ESG Adoption

For ESG strategies to capitalize on this steadily growing interest and gain wider adoption in the North American market, several things need to happen along the institutional investment supply chain:

- Individual plan beneficiaries and fund stakeholders must determine if ESG strategies represent their best interests. If so, they need to convey that message up the chain of command.

- Fund-level leadership needs to believe beyond a shadow of a doubt that ESG strategies won’t compromise their fiduciary duty to provide optimal outcomes for stakeholders.

- Managers and consultants need to take on an advisory role, leading the conversation on ESG topics and providing clarity to institutional investors.

The Future Looks Bright

Clearly, as the conversation on ESG develops in the months and years ahead, there will be several challenges to broader acceptance. Still, we are encouraged by the enthusiasm and activism we see in the market.

While the North American ESG wave may still be on the horizon, we’re confident that ESG becoming firmly established in the North American institutional market is a question of “when”, not “if.”

Related Research

Impact Investing: Individual Investors Seeking New Opportunities

This report is based on a study to better understand how the intermediary-sold market views and treats impact investing.

Impact Investing: Institutions Awaken to New Possibilities

Over the past decade, growing numbers of both institutional and individual investors have started considering the social impact of their investments.