Interest in private markets hasn’t slowed down. Our data-driven insights based on feedback from asset owners in the United States show that, despite signs of a slowdown in fundraising, private investments are expected to again claim the most significant allocation increases across U.S. institutional portfolios over the next three years. This finding is no surprise, as private investments continue to generate attractive risk-adjusted returns and access to high-growth opportunities. Furthermore, allocation to private markets also provides investors with effective tools to cope with some of the key challenges they face currently.

Interest in Private Markets Remains Strong

In 2022, institutional investors put market volatility and inflation risk at the top of their list of concerns. Compared to public markets, private investments offer relative stability due to their longer investment horizons and a lack of real-time pricing. Asset classes such as private debt and real estate also offer a degree of protection against inflation concerns by giving exposure to inflation-hedging assets and ongoing cash flows. As a result, following decades of strong growth in private markets, institutional interest remains significant even as the investing environment has become more challenging recently.

Seeking a Track Record in Private Markets

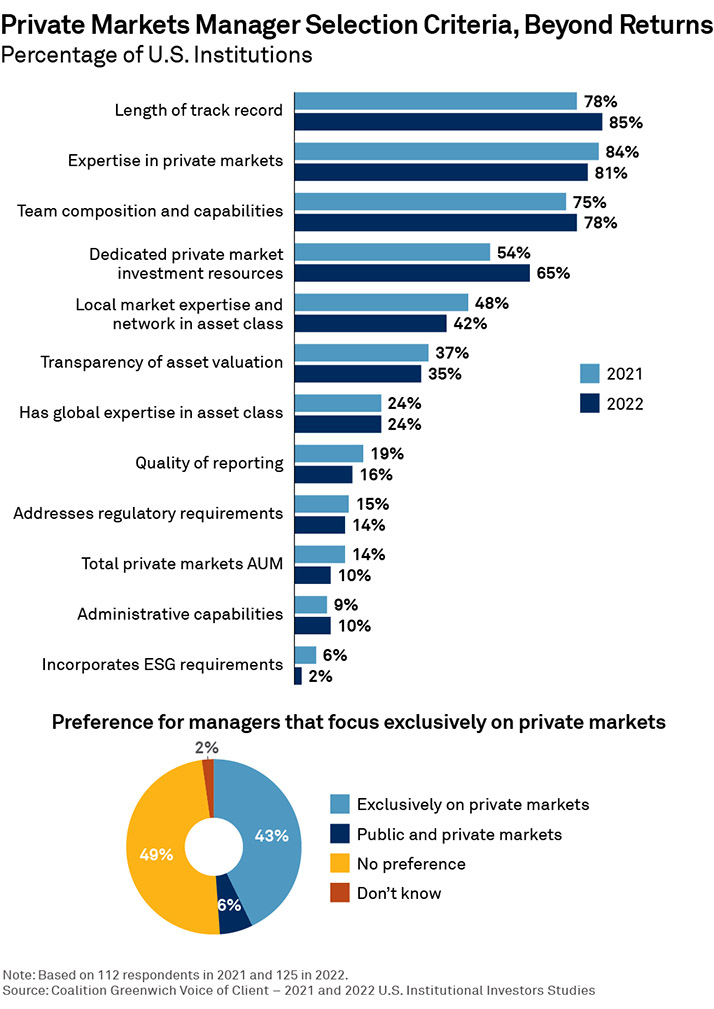

The nature of private market investing also means that managers competing for a share of the flow are often required to demonstrate a particular set of capabilities and attributes. In particular, investors are looking for expertise in private markets, demonstrated over time. A lengthy track record demonstrates an asset manager’s ability to weather various market conditions and offsets the difficulty in evaluating performance due to infrequent valuation and lack of benchmarking. It serves as a reliable indicator of a manager’s ability to generate consistent returns and manage risk effectively while navigating an illiquid market.

For about half of U.S. investors, however, this hasn’t translated to a preference for managers that focus exclusively on private markets. But with the complexities specific to private markets, investors are looking for evidence of a manager’s commitment to the asset class. Instead of delineating between specialist and generalist managers, the majority of investors cite the existence of dedicated private market investment resources as a requirement for selection, and this proportion has increased significantly from the previous year.

Evolving Through a New Phase

With fundraising slowing in recent quarters and the private markets evolving through a new phase, investors will become more selective when evaluating managers and strategies. Investors can be expected to place an even higher importance on evidence that demonstrates a deep expertise in the private market space. A robust track record is a distinct advantage as it instills confidence and trust in a manager’s ability to deliver results long-term, as well as their ability to uphold their investment philosophy and approach through market cycles.