Table of Contents

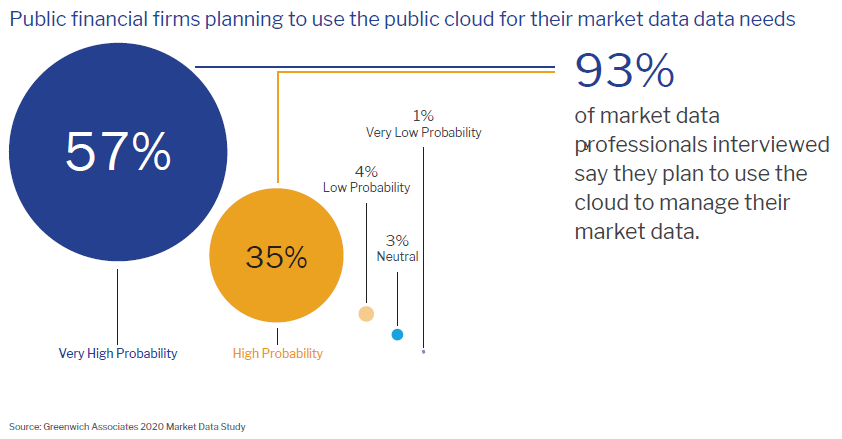

Cloud computing has reshaped the consumption, analysis, management, and distribution of market data. As the digital transformation of capital markets continues - increased use of mobile devices, more automated trading, seemingly endless sources of data—keeping up is all but impossible without putting the cloud to work. Greenwich Associates research shows market participants have heard that message loud and clear with 93% of market data professionals saying they plan to use the cloud to help manage their market data going forward.

But even while using the cloud to store historical data, analyze large data sets and to run enterprise applications is largely accepted as good practice today, there remains a misconception that the cloud is not suited to handling real-time market data. With real-time data, latency is key, and the extra “hops” needed to get into and out of a cloud environment have been viewed as non-starters.

The Latency Problem?

In today’s market however, the reality is that very few firms compete on latency. The majority now feel they are “fast enough”, with a very small number of electronic market makers making money based on the speed of their infrastructure over another’s.

In practice, this means that the latency problem has largely been isolated to a very few specific applications, with market infrastructure so efficient that “hopping” in and out of the cloud does not have a meaningful impact on data consumption or delivery—and often is better than legacy infrastructures some firms are still running in-house. To put it simply, real-time data in the cloud is now very viable choice for most market participants.

More Than Trading

The value proposition is even greater in the middle or back office, where real-time data is consumed not for trading but for market monitoring, and is often viewed on the screen (and not via an algorithm), where the literal blink of an eye introduces magnitudes more latency than the cloud ever could. And in an ideal world, managing real-time data via the same cloud-based platform as all of your other data further enhances the firm’s ability to manage data usage, streamline access to new data sources and, of course, reduce costs.

If a real-time market data infrastructure was created from scratch today, there is no debate that a centralized, native cloud-based approach would be a key component of the architecture. And even though only a small few have the luxury of building from scratch, the tools to create a cloud-centric data infrastructure that includes real-time market data applications are there for the taking.

A closer look into recent Greenwich Associates market data research and the use of market data in the cloud in general can be found in a recent Xignite whitepaper published in April 2020.