Table of Contents

Earlier this month, we reached out to buy-side fixed-income investors in the Americas to learn more about the impact of COVID-19 and dealers’ response.

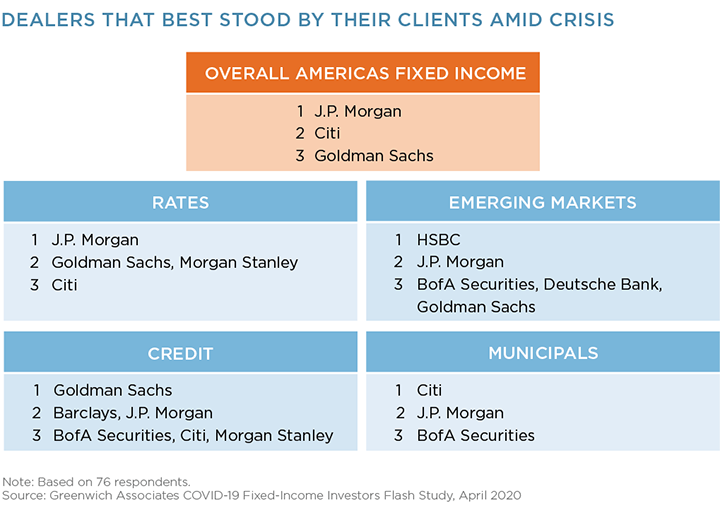

One question we asked was, “Which dealers do you feel have stood by you the best during the current turbulent market conditions?”

This was asked on an open-ended basis—respondents could name multiple dealers or “none,” or even sound off on the lack of liquidity they were seeing.

And to be clear, some investors were unimpressed with the sell side’s response, particularly in spread products. Rates investors almost always named at least three standout counterparties, whereas responses in spread products were much more varied.

Standout Dealers

With this said, some dealers have consistently stood out over the past month in Americas fixed income.

J.P. Morgan received the most mentions by a fairly wide margin and was recognized as a reliable partner in each product area. Citi received the second most votes by virtue of consistency across products vs. standing out in two or three, followed closely by Goldman Sachs.

Outside of the bulge bracket dealers, Citadel Securities stood out in rates for their support by a high proportion of their clients.

Dealers Response to Clients

As discussed more thoroughly in our previous blog, Partnering with Clients in a Time of Market Turmoil, 42% of buy-side firms named more sales contact as the most helpful action their dealers have taken, emphasizing the importance of maintaining relationships during this time.

While relationships between investors and dealers have been tested by market turmoil before, the circumstances brought about by COVID-19 have been unique, especially with such a large percentage of market participants trading from home.

We expect the dealers that stand tall for clients during these challenging times to reap the rewards of increased client activity in the coming months.