The world of asset management is undergoing a seismic shift, and at the heart of this transformation is artificial intelligence (AI). Last month, Coalition Greenwich conducted a study with 99 large asset managers globally that reveals how AI is changing the landscape of this industry. It's not just a buzzword—it's a game-changer that's poised to redefine how asset managers operate, compete and deliver value to their clients.

The AI Adoption Spectrum

When we asked asset managers about their AI adoption, the numbers paint an intriguing picture:

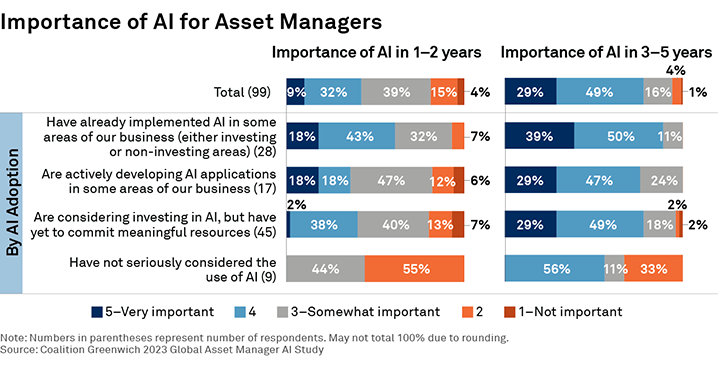

- 28% of asset managers have already embraced AI in various aspects of their business. These are the pioneers, venturing into the uncharted waters of AI implementation.

- 17% are actively developing AI applications, showing that they recognize the potential and are actively working on harnessing it.

- 46% are considering investing in AI, though they haven't yet fully committed. This group represents the thoughtful evaluators, carefully weighing the benefits before diving in.

- While 9% have not seriously considered AI, there is something to be said for embracing a last mover advantage, particularly when it comes to untested technology.

AI: The Competitive Edge

Now, let's talk about the competitive advantage that AI presents in the asset management realm. In the short term, 41% of respondents believe that AI will be a game-changer within the next 1–2 years. This number might seem modest, but it indicates that some see AI as an imminent disruptor.

Looking further ahead, the picture is more bullish in 3–5 years, with nearly 4 out of 5 of managers seeing AI as a future cornerstone of success in asset management. What's particularly interesting is that even among those who haven't considered AI seriously, many still acknowledge of its importance in the medium term, suggesting that the awareness of AI's potential is spreading and curiosity among those who haven't yet embraced it is growing.

The Multifaceted Benefits

The benefits of AI adoption in asset management potentially extend far and wide, though the primary advantages are perceived to be around the optimization of internal processes and the reduction of costs, indicating that AI can have a tangible impact on the bottom line.

One of the most exciting aspects of AI's integration into asset management is its anticipated impact on research and idea generation, as well as opening up possibilities for more targeted and effective marketing strategies. Indeed, these are the very areas where managers are concentrating their current AI application efforts.

Challenges and Preparedness

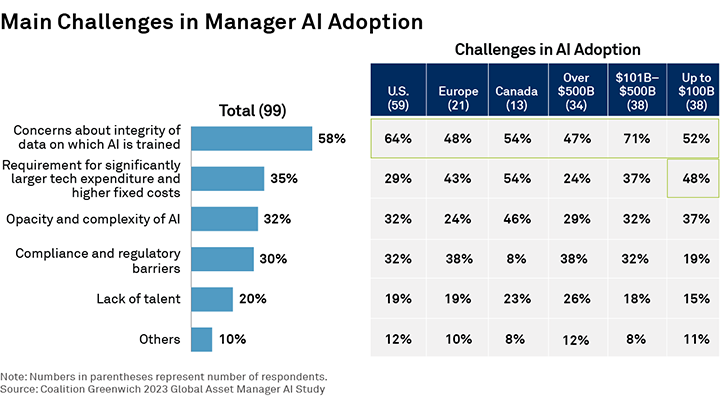

AI adoption isn't without its challenges, with 58% of managers expressing concerns about the integrity of data used to train AI. And roughly a third cite issues with costs, the opacity of the programs and compliance and regulatory barriers.

Strikingly, while 78% of managers feel that AI is likely to present a significant a competitive advantage in the next 3–5 years, only 17% currently feel prepared to capitalize on the opportunity, which highlights a significant gap between the potential benefits and the industry’s level of readiness to leverage the technology.

One of the most intriguing findings is that 55% of asset managers have engaged their clients in discussions about AI. This reflects a growing awareness that clients are interested in the impact of AI on their investments.

Embracing the AI Revolution

The study paints a compelling picture of AI's growing importance in asset management. It's not just a technology trend; it's a fundamental shift that has the potential to reshape the industry's future. Asset managers who embrace AI are not just looking to reduce costs—they're optimizing processes, enhancing portfolio performance and aiming to deliver superior client service.

The journey toward AI adoption might come with challenges, but as we look ahead, it presents a path that promises greater efficiency, effectiveness and competitiveness. The question before us is, can it deliver?

Sophie Emler is the author of this publication.