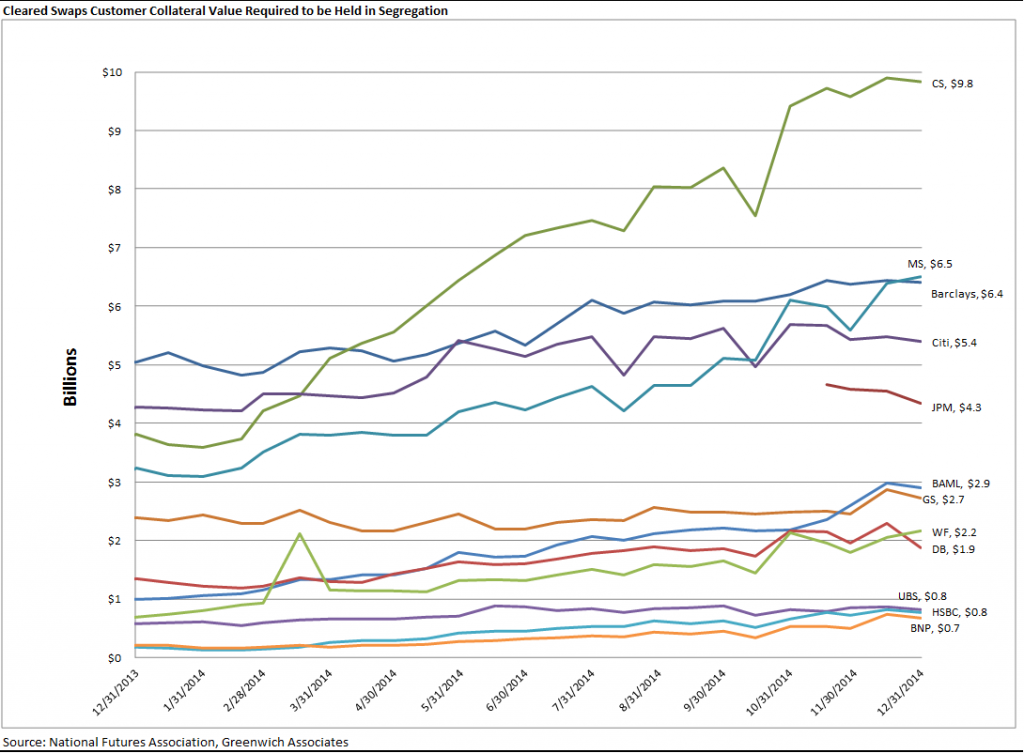

Last fall we published research that showed how trading in the interest rate swaps market has become even more concentrated with the top five dealers since Dodd-Frank, rather than more competitive as regulators had hoped. It should come as no surprise then that swaps clearing is moving in the same direction. According to data from the NFA, 73% of cleared swap customer collateral required to be held in segregation sits with the top 5 FCMs (out of the 12 reporting). There are two major drivers for the trend:

First, its pretty hard to make money clearing swaps in the US. I will save the quantitative analysis explaining why for a future research paper, but simply put the cost of capital combined with client willingness to pay has left most players looking to raise rates (particular for those customers that use lots of capital but trade very infrequently).

Second, its much more efficient for clients to concentrate their clearing business with a small few FCMs - one if possible. Margin optimization is much easier when using a single FCM. Equally important for investors today is retaining platinum customer status with their biggest dealers to ensure access to research, liquidity and everything else global banks have to offer. With total market volumes down, clients are doing this by sending what flow they are generating to fewer dealers.

The data speaks for itself. This trend shows only signs of continuing throughout 2015.