On May 28, 2024, U.S. equity trades will settle next day. While this might evoke a sense of déjà vu, it is different this time. Really.

In 1995, U.S. securities settlement shortened from T+5 to T+3. Soon after, advocacy groups and management consultants alike suggested a move to T+1, or even same-day settlement, to further reduce risk and improve market efficiency. Met with mixed reception, some feared the move would actually increase costs and risks, and that such a shortened settlement period would not provide enough time in the event of a market disruption. After all, the first World Trade Center bombing was still fresh in the Street’s memory.

Y2K and 9/11 Set the Stage

Around the year 2000, I helped write a white paper along the lines of “T+1, next-day settlement and the movement toward straight-through processing.” Having joined PricewaterhouseCoopers’ Financial Services & Technology practice a year earlier, my first assignment was working on Y2K planning for the Securities Industry Association (SIA), a precursor to today’s SIFMA. Our team ran the project management office. The week going into New Year’s, I worked overnight in the “command center” at 55 Water Street, ending most shifts across Hanover Square at the Killarney Rose. For those who don’t recall, New Year’s Eve was a Friday night. Upon return to the office Monday morning, I was handed David Weiss’s seminal book “After the Trade Is Made.” The SIA had another project for us: exploring the feasibility of further reducing settlement cycle to T+1 by 2005. I was now to be a settlements specialist.

But fate, as it so often does, had a different path in mind. In late September 2001, I was abruptly reassigned to a new project. The financial industry needed a new command center, and they needed it quickly.

The 9/11 attacks highlighted the need for greater efficiency and resilience in the U.S. markets. Over the next several years, the industry continued to discuss and evaluate shortening the settlement cycle as a way of reducing risk. A 2004 SEC Concept Release included seeking comments on the costs and benefits of implementing a settlement cycle shorter than three days.

However, in a related comment letter the SIA stated it had shifted focus from specifically shortening settlement to a more holistic goal of achieving straight-through processing (STP) across the industry. This meant automating the entire trade life cycle for every participant, with no manual intervention between execution and settlement. The SIA stated the industry would be better off by setting goals, like same-day affirmation, to achieve STP over several years, rather than specifically targeting T+2 and fewer.

Consequently, the SEC withdrew the concept release, opting to revisit the matter once the industry had matured technologically, developing the necessary frameworks and workflows to render a shortened settlement period feasible.

Everything Old Is New Again—Now, the Industry’s Ready

In 2017, with the specter of the global financial crisis still in the industry’s collective consciousness, the SEC proposed a move to T+2. The vote was unanimous, and the shortened settlement cycle went into effect that September. Since then, the pandemic market shock, the meme stock craze, Robinhood’s infamous halt on trading GME, and the world’s blockchain obsession have all highlighted the vulnerabilities and opportunities the current settlement process presents.

T+1 offers a tangible solution. Notably, it also alleviates the capital requirements burdening retail brokers, with DTCC estimating a 41% reduction in the volatility component of its NSCC margin requirement, potentially resulting in billions of dollars of savings for member firms.

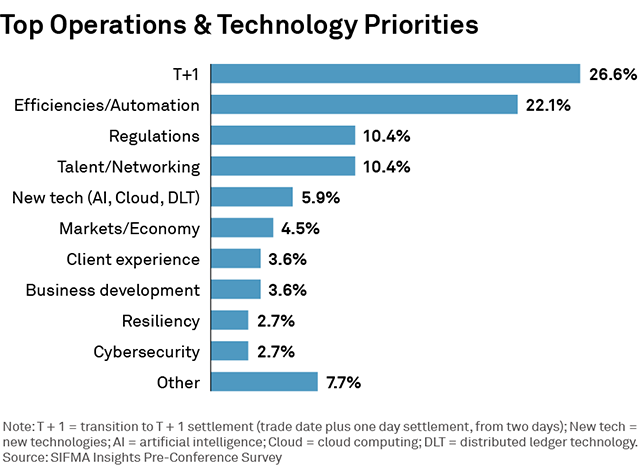

So what’s different about T+1 this time? For starters, there is broad industry support. In fact, T+1 was voted the top operations and technology priority in a pre-conference survey from SIFMA Insights heading into the SIFMA’s Operations Conference in May. Why not? The industry has invested countless hours in meticulous planning and has over three decades of experience in shortening settlement cycles. Market participants across the spectrum possess an intimate understanding of the prerequisites, requirements, dependencies, technology, roadblocks, timelines, and myriad other factors essential for a successful, seamless transition.

Technological advancements have significantly improved the efficiency and speed of securities processing as well. Thanks to a more sophisticated and automated infrastructure (albeit not one built on a blockchain), the industry is properly (and finally) equipped to navigate the challenges of shortening the cycle.

More than U.S. Equities

Other markets are taking strides toward T+1 settlement. The U.S. initiative encompasses all securities, so fixed-income markets are part of this move as well. Canada has announced its implementation scheduled for May 27, 2024, a day before the United States. Meanwhile, in Europe, the Association for Financial Markets in Europe (AFME) is exploring the path to T+1. To them, it is not a question of if, but how and when. Additionally, the emergence of digital assets and ledger technology exerts pressure on the industry, urging them to streamline processes and workflows across equities and other asset classes.

Most folks are tired of talking about the equity market proposals and the MiFID II no-action letter. It’s a somewhat quiet period in equities regulatory land right now, but firms can be productive while waiting for guidance. And while summer may not be the most favored season for embarking on new endeavors, it’s a great time to assess potential impacts and ascertain one's readiness for the forthcoming shortened settlement cycle.

For those that haven’t seen it, The T+1 Securities Settlement Industry Implementation Playbook published by SIFMA, ICI and DTCC is a handy guide for the industry. We wouldn’t dare suggest it as ideal summer reading material, but it will be far more digestible this year than next, as the deadline looms.