Investors Are Seeking New Differentiators

Thought leadership is easily and often recognized as a “nice to have” value-add. Half of U.S. investors in a recent Coalition Greenwich study identified it as a key contributor to a best-in-class brand, and a similar percentage reported it was fundamental in gaining familiarity with an asset manager. But faced with fee compression and low dispersion of returns in many asset classes, institutional investors and pension fund consultants are increasingly incorporating thought leadership and knowledge transfer as “need to have” factors in their manager selection process.

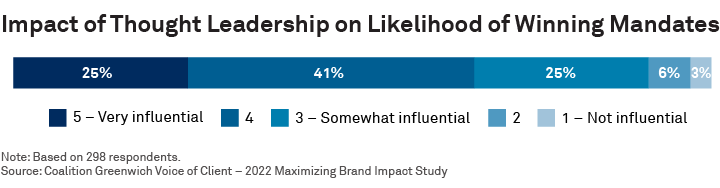

In the same study, two-thirds of global investors reported thought leadership had a high impact on the likelihood of winning mandates. In a hypercompetitive and highly commoditized market, managers that create, package and distribute differentiated thought leadership with actionable advice can tip the scales in their favor.

Pandemic Impact and the “New Normal” Reset

With the onset of COVID-19, asset managers embraced and adapted to virtual relationship management. Almost overnight, managers began to produce podcasts and webinars, and develop social media touchpoints. It was a remarkably nimble shift to information delivery as institutional investors, facing unprecedented market conditions—and elevated free time previously taken up by commutes, long meetings and social activities—reported a meaningful increase in their thought leadership consumption during this time.

But now the pendulum has swung back, and managers are struggling to fine-tune their thought leadership strategy. Investors are inundated with content, and with only so many hours in a day, much of it goes unconsumed. In our annual Institutional Investor Study, the top 10 managers who were most consistently selected as an asset owner’s “best source of intellectual capital” in 2021 saw an average decrease of 10% in those citations.

This flattening of the curve could be great news for the smaller shops, as the traditional thought leadership powerhouses slip in their rankings, but we haven’t seen a corresponding uptick from lower-ranked managers. In other words, the market is flooded, and investors are having a harder time identifying exactly who their best source of content is. Client demand for thought leadership isn’t decreasing, but it’s becoming increasingly difficult for managers to stand out in the sea of offerings.

Thought Leadership 2023 and Beyond – Best Practices

Our latest research module, fielded in Q1 2023 as part of our annual Institutional Investors Study, seeks to better quantify the components of successful thought leadership strategy from the perspective of institutional asset owners. Beyond the easy-to-preach best practices—timely, relevant, actionable—successful thought leadership hinges on developing a partnership mindset with clients and matching their content consumption patterns with the right deployment strategy.

In this blog series, we aim to identify some basic patterns within investor groups, such as the preferred frequency, length and medium of content consumption. Beyond that, we’ll look at more nuanced components: Do investors prefer to seek out thought leadership on their own, or have it delivered to them at a specific cadence? Are investors widening or narrowing their horizons in terms of where to access content? For which asset classes—and which issues within those asset classes—are they turning to thought leadership?

We don’t expect to see a clear, one-size-fits-all answer. Investors are consistent in their articulation of the key role that content plays in their relationships with managers, but in a diluted marketplace, deployment strategy can determine whether content is consumed or not. Tailoring content to fit investor type, size and behavior is a science that all managers wishing to gain an edge in the marketplace need to learn.

Follow our blog series on the latest updates from the asset management industry as we explore the results of this new study.