Table of Contents

There still seems to be a misconception that markets primarily driven by central limit orders books (CLOBs) are the most liquid, and that all other markets should strive to move in that direction.

Despite numerous attempts to move the fixed-income market toward order book trading, including those from Congress (remember Dodd-Frank when it was a bill and did not yet include “any means of interstate commerce”?), the Gary Gensler CFTC and a few startups, institutional investors continue to vote with their feet.

Buy Side Not Interested in Trading U.S. Treasurys in CLOB

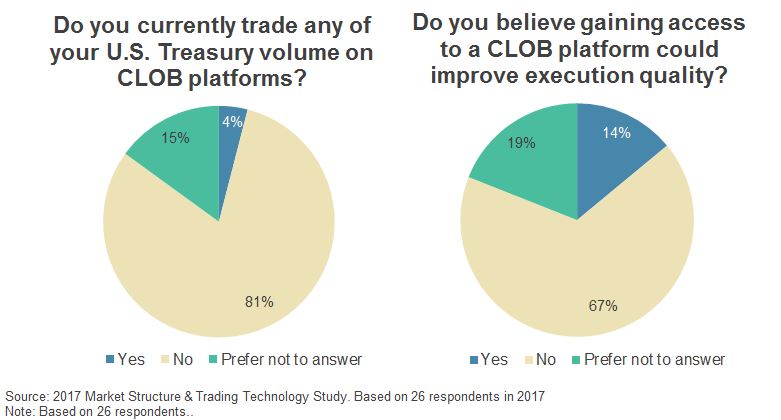

A question we posed in a recent research study to the buy side was, first, do you trade on-the-run U.S. Treasurys via an order book? 95% said no. We then asked if they thought gaining access to an order book market for U.S. Treasurys would improve their over execution quality - only 16% thought it would. Given that almost 90% of our study participants believed that trading on-the-run U.S. Treasurys in sizes up to $15 million was easy, the limited impetus to change isn’t all that surprising.

Why fiddle around with executing a large order in bits and pieces with principal trading firms when you can either RFQ it or make a quick call to a primary dealer and get the whole thing done in one shot? Numerous Greenwich Associates studies and periodic conversations with real-money U.S. Treasury investors over the past few years lead us back to the conclusion that the buy side just isn’t interested in trading U.S. Treasurys in a CLOB.

That’s a big, bold statement—we know.

It is very possible that many investors just don’t know what they’re missing. For instance, given the relatively limited use of transaction cost analytics (TCA), most buy- side traders have limited means to measure execution quality in such a way that they can justify changing their workflow.

This makes measuring the value of anonymity in the market, a big potential benefit of order-book trading, challenging. In addition, gaining access to order-book platforms such as BrokerTec and Nasdaq Fixed Income (formerly eSpeed) continues to be non-trivial, whether due to technical integration issues, compliance concerns or concerns of damaging critical dealer relationships. Taking that risk for many just isn’t worth it. You never get fired for buying IBM (or trading via RFQ, in this case).

Too Early to Write Off Buy Side’s CLOB Adoption

But let’s not write off the buy side’s adoption of order-book trading so quickly. Five short years ago, no one thought all-to-all trading would work for corporate bonds—and here we are.

Rate futures, which by some measures make up a bigger portion of the market than the bonds themselves, trade in an order book with volumes continuing to grow.

Innovations in TCA, execution algorithms and liquidity aggregation are also progressing more quickly today than ever before, with the buy side increasingly tempted.

And lastly, with the big banks focusing their capital and best people on their biggest clients to improve return on equity, smaller investors are more willing and able to take a self-service approach than ever before.

Fixed-income markets continue to show us that no single trading protocol works for everyone. Choice is key, and order-book trading will over time be yet another tool for investors alongside RFQ, auction, aggregated streams and, yes, the phone. But no, the U.S. Treasury market is not like the equity market, and we don’t really want it to be.