We've just released the results of our benchmark US equities study, based on almost 600 interviews with US equity investors. While Greenwich has been conducting this study for literally decades, this is my first market structure analysis of the data since joining the firm last summer. The report includes the expected critical data points - total commission wallet, average commission rates, levels of electronic trading, broker provided algo quality rankings and others. But we also dig into the "why?" of each trend we found and how we expect the market to evolve going forward. The series of reports is available to Market Structure and Technology clients, with a summary provided below. And no, the market is not rigged (I couldn't help myself).

New Greenwich Associates Report Finds Little-to-No Growth in Electronic Trading

Bulge Bracket Brokers Ceding Market Share to Mid-Tier Firms

For the first time in five years, the total amount of commissions paid by institutional investors to brokers on trades of U.S. equities increased from 2013 to 2014, according to a series of new research reports from Greenwich Associates. The studies, based on 590 interviews with US institutional equity traders and portfolio managers in the first quarter of 2014, also found that customer electronic trading has remained relatively flat while mid-tier brokers have gained share on the bulge bracket, providing both sector specific trading and research services to institutional clients.

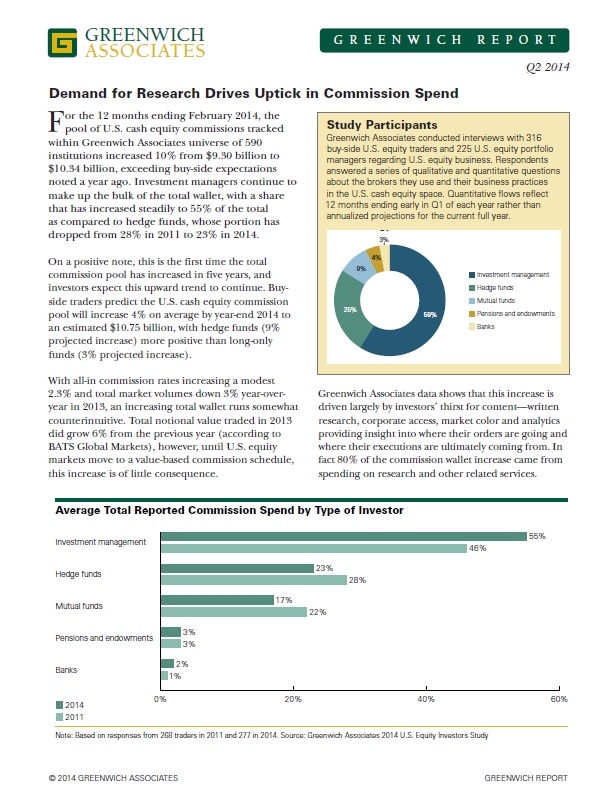

For the 12 months ending February 2014, the pool of U.S. cash equity commissions increased 10% from $9.30 billion to $10.34 billion. All-in commission rates also grew slightly for the first time in five years, ticking up just over 2% from 2013 levels. This increase was driven largely by investors’ thirst for content—written research, corporate acesss, market color and analytics providing insight into where their orders are going and where their executions are ultimately coming from. In fact 80% of the commission wallet increase came from spending on research and other related services.

Electronic trades accounted for 37% of institutional trading volume in U.S. equities from 2013 to 2014, essentially unchanged from 36% the prior year. While the demand for content largely explains the continued share of flow directed to high-touch channels, a the lack of growth seen in electronic trading over the period initially appears counterintuitive. Buy-side trading desks are resource constrained, averaging just under four traders according to Greenwich Associates Trading-Desk Organization Study. Fewer traders handling more flow means increased interest in trading electronically. Due to similar resource constraints and shifting business models, top-tier brokers are encouraging the e-trading behavior investors are asking for. Given this perfect match of incentives, supply and demand should lead to continued e-trading growth. However, despite the buy side’s best intentions, the need for content and other related factors have kept e-trading levels well below expectations

The sell side competitive landscape also showed signs of its continued evolution. While the top tier still sees the majority of the flow, Greenwich Associates data shows a strong trend towards mid-tier brokers for both execution and research. In 2007 the bulge bracket had a 78% share of trading and 71% share of research. In 2014, the bulge bracket now has only 64% of trading and 53% of research, with mid-sized/regional brokers and sector specialists benefiting. The importance of mid-tier brokers is the most noticeable in research, as they now account for 40% of the research wallet. When asked which firms are most important for small/mid-cap research and advisory, of the top 10 firms cited by investors seven fall into the mid-tier bucket. “Investors don’t want a jack-of-all-trades, they want a master-of-one,” says Kevin McPartland, Greenwich Associates Head of Market Structure and Technology Research.

At first glance, this shift seems cause for concern for bulge bracket firms. After all, big banks have endured margin compression brought on by new capital requirements, shrinkage of formerly high-profit fixed income, currency and commodities (FICC) businesses and a general slowdown in revenues from trading. The loss of share in a cornerstone investment banking function such as equity trading and research could be seen as just one more piece of bad news. But when assessing combined high-touch and low-touch commission flows, the top nine firms still control an aggregate 64% share of commission. “While bulge bracket providers have seen their presence in U.S. equity research eroded, they have done a much better job protecting their actual commission share in trading—the engine of revenues and profits in the equities business,” says Greenwich Associates Managing Director Jay Bennett.