Two decades ago, exchanges and electronic trading venues were seen as offering two things—a marketplace for buyers and sellers to interact and market data reflecting the results of those interactions. Today’s global fixed-income trading venues offer so much more.

A half-dozen trading protocol options is not unusual. Post-trade data is just table stakes, with pre-trading analytics and transaction cost analysis (TCA) now front and center. And the user interfaces offered by the largest bond venues act as execution management systems (EMSs) in their own right (save connectivity to competing venues, which very well may be coming soon).

For the buy side, access to liquidity still matters. But now that the overlap of liquidity providers from venue to venue is over 90%, it is increasingly these value-added services and solutions that ultimately attract investors.

More All-to-All

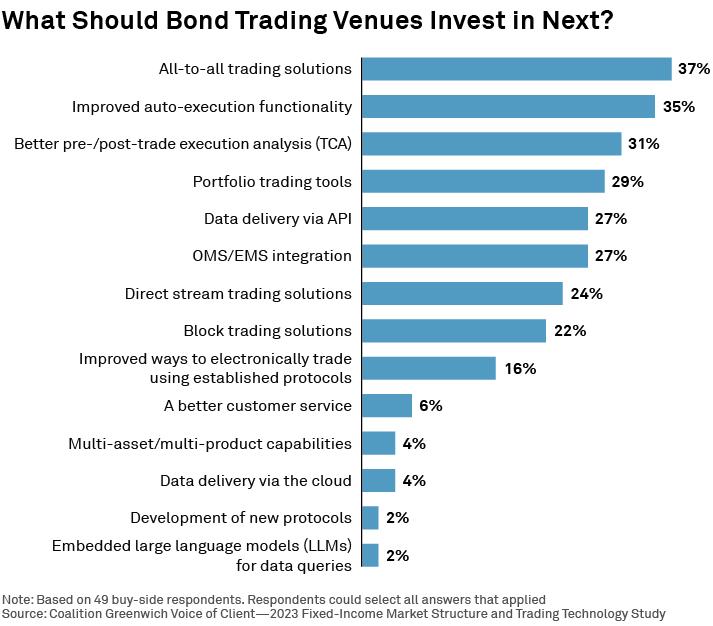

In Q4 2023, we asked 49 bond investors, mostly in the U.S. and Europe, what they’d like their trading venues to invest in next (check out what the buy side wants from their dealers here1). Despite a long and steady growth trend, all-to-all trading continues to top the list.

Coalition Greenwich data shows that just over 17% of U.S. corporate bond e-trading was executed via anonymous RFQ in 2023, the most common all-to-all protocol, up from virtually zero a decade ago. The buy side has clearly seen the value in seeking liquidity from the entire market, expanding beyond their dealer list, and they want more. U.S. corporate bonds are the biggest all-to-all success story, but opportunities for growth are abundant in European, Asian and Latin American corporate bond markets. And despite the heavily electronic nature of U.S. Treasury markets, true all-to-all trading remains virtually non-existent, despite buy-side demand (we examined this closely here2).

Improved auto-execution functionality was a close second for the buy side (it was the top request when asked what bond dealers should invest in next). Trading volumes are getting higher, but trading desk headcount is not. This has forced automation up the priority list for fixed-income investors, with auto-execution a relatively easy win toward that goal.

While adoption is still relatively low if you consider the long tail of smaller asset managers and hedge funds in the market, some trading venues are offering customers configurable tools that will auto-route orders meeting certain criteria (e.g., under a size threshold, with a certain liquidity score) to a set of dealers (that is also configurable), and then accept the best price received without any trader intervention required. When you hear about algo trading in the bond market right now, this is it.

So Much More

Additional requests from the buy side run the gamut but largely fit into a few buckets: trading protocols, data and workflow improvements. The last 10 years have shown us that trading protocols are often what attract volume, while data and workflow improvements are what keep volume captive.

TCA has also been top-of-mind in bond markets for a decade and still continues to be a focus. The challenge has been to take fixed-income TCA further from art and closer to science, something we think the advent of AI and the treasure trove of data available to market participants today are finally allowing to happen.

It’s not surprising to see portfolio trading, block trading and access to direct, streaming pricing high on the list—protocol diversity is a big part of why e-trading has grown in general (although almost no respondents want more new protocols!). And on the workflow front, OMS/EMS integration and API connectivity resonated with over a quarter of our respondents.

What doesn’t matter to the buy side? Customer service only received a few votes, but remember we asked where venues should invest in next, not “what do you care about.” The optimistic analysis of this result is that the market is so competitive that customer service is also table stakes, and big trading venues today are delivering on this front.

More interesting was the lack of enthusiasm about large language models and cloud. Investments in these areas matter to most trading desks more than they know or would like to admit, but the impact of these things on trading performance today is hard to quantify when compared to the more concrete focus areas above.

The moral of the story is that despite the incredible growth of fixed-income e-trading and the trading venues that support it, the buy side wants more. No resting on your laurels.

Kevin McPartland is the author of this publication.

1https://www.greenwich.com/blog/what-buy-side-wants-their-bond-dealers

2https://www.greenwich.com/market-structure-technology/us-treasury-market-reform-buy-side-view