Using advanced statistical methods, banks can base resource allocations, marketing initiatives or product development strategies on the full picture of each segment's needs, behaviors and financial value.

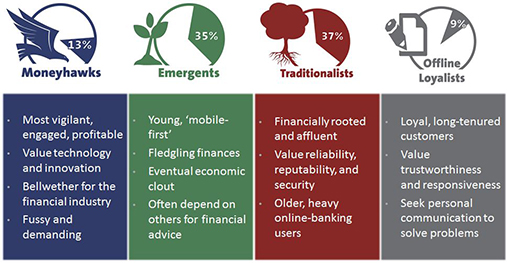

Javelin, a division of Greenwich Associates, created a customer segmentation approach for retail banking, which draws upon financial attitudes and banking behaviors, affinity for technology and demographics, such as age and income.

See how Javelin's approach compares to simple segmentation practices.

Bottom Line

Advanced segmentation facilitates a true ROI analysis to prioritize among strategies, with the ability to estimate the number (and profitability) of customers who will be more likely to adopt certain product combinations or respond positively to various sales or marketing approaches.

This approach also makes it possible to determine how many customers or prospects have needs and preferences aligned with the bank's competitive strengths, as well as the likely payoff of shoring up areas of weakness.