Bank switching among small businesses and mid-sized companies has increased for the second consecutive year. Nearly 25% of both small businesses and mid-sized companies moved all or part of their business to another provider during the last 12 months.

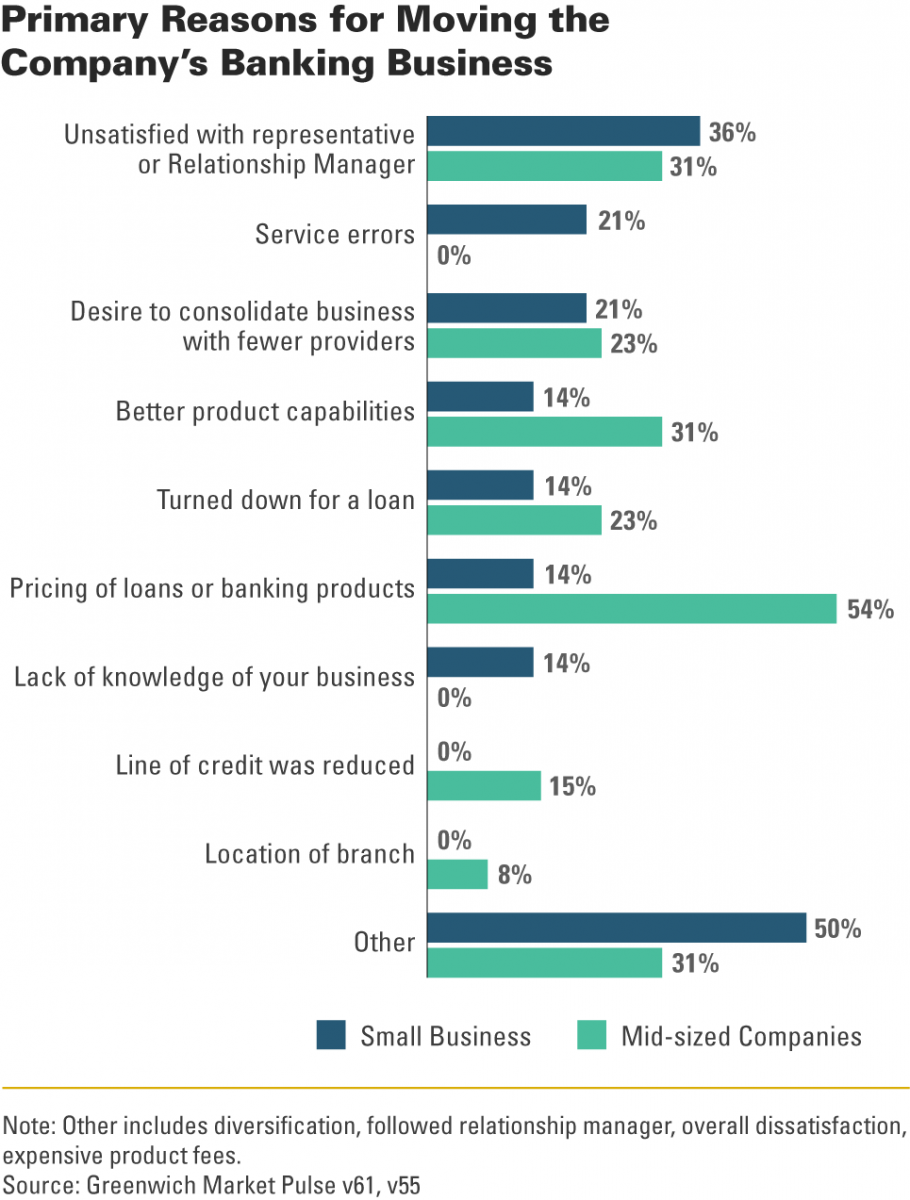

For small businesses, the most common reason for switching banks was dissatisfaction with their bank's representative or relationship manager. Mid-sized businesses share common frustrations, and also note that slow response times, customer service and industry understanding are big concerns.

Bottom Line

The risk today is companies now have the option of switching to non-bank providers that are leveraging regulatory and technology advantages to deliver high quality service and competitive pricing.

Approximately one in four U.S. small businesses and mid-sized companies obtained credit from non-bank providers. Nearly all say the experience was so positive that they would borrow from non-bank lenders again.

To overcome non-banks' competitive advantages, banks need to engage in meaningful, relationship-building dialogues with their customers while working to improve their pricing and service.