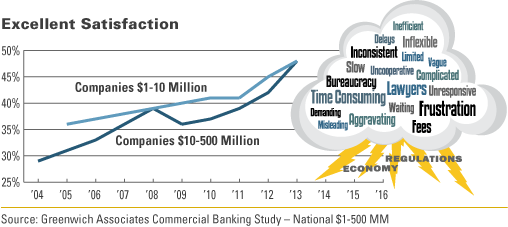

Despite the steady increase in relationship quality, there are indications of a potential storm on the horizon. Costly regulatory compliance, a weak economic recovery, and resource intensive service models are testing banks’ traditional business models. As successfully serving clients becomes increasingly complex, banks will be forced to compete on "Ease of Doing Business", in addition to products, price, and people.

Banks must act quickly to streamline processes and limit redundancies in documentation requirements that generate frustration. Greenwich Associates research shows Ease of Doing Business is now the single most important driver of banking relationship quality. Those institutions that get the “service and ease” model right will be rewarded as others struggle, or fail, to buffer their clients from regulatory headaches.

Protecting customers from the burdens of compliance will effectively provide shelter from the storm. In order to do this effectively, banks will need to concentrate efforts on the following four key areas:

- Establish a single point of contact

- Reinforce responsiveness

- Ensure products and services match segment needs

- Maintain local decision-making authority