Table of Contents

Relationships between banks and their commercial clients have hit a rough patch.

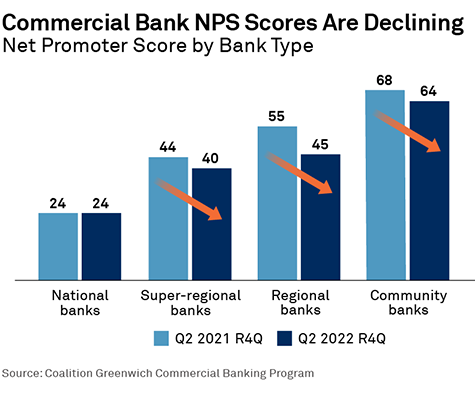

Over the past year, key measures of client satisfaction have tumbled for commercial banks, with average Net Promoter Scores (NPS) dropping four points for community banks, 10 points for regional banks and and four points for super regionals.

While average NPS scores for the big national banks avoided declines by holding steady from year to year, that might be little solace to the small businesses and middle market companies that make up their client bases. As a group, national banks receive by far the industry’s lowest NPS scores. Even after last year’s deterioration, community, regional and super-regional banks outpace national banks in NPS by a significant margin.

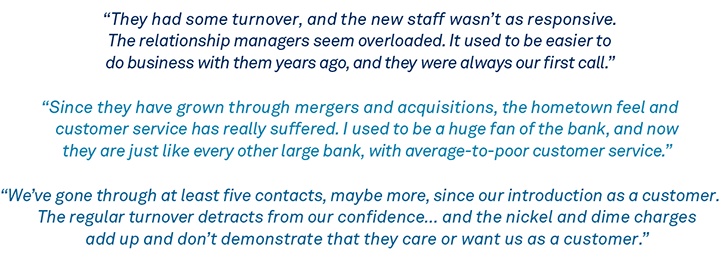

Here are some of the comments that companies participating in our study made to describe the service and overall client experience they received from their banks over the past 12 months:

What’s behind clients’ dim assessments of their commercial banks? Cyclical conditions are undoubtedly playing some role. In a choppy economic environment, small businesses and midsize companies might be looking for extra support or advice that they see as lacking. Clients might feel particularly adrift if they received special attention from their banks during the COVID-19 crisis and the PPP process. In most cases, banks have now withdrawn those pandemic-era support structures.

Mergers and acquisitions are also playing a part. More than a quarter (27%) of commercial banking clients say their bank has been part of a merger or acquisition over the past two years. Of those, about 40% say the transaction had a negative impact on their client experience. “Merger integration is a complex, disruptive and draining process that often causes banks to take their eyes off the ball when it comes to basic client service,” says Coalition Greenwich Head of Digital Benchmarking, Chris McDonnell.

Regardless of whether they are involved in M&A, many banks—especially national banks and some super regionals—are in the midst of sweeping digital transformations designed to revolutionize the way they run their businesses and service clients. While these efforts will eventually pay off in the form of streamlined processes and enhanced functionality, in the short term they often disturb banks’ internal workflows and cause delays and headaches for clients, as their providers transition to new systems.

Finally, clients might just be expecting more from their banks in terms of service and experience. When business owners and corporate executives are enjoying the seamless service they receive from companies like Amazon and Apple, it inevitably colors how they rate the service they receive from banks. “When you know that a swipe and click can get something delivered to your doorstep within hours, it makes it extra frustrating to be re-entering your Tax ID for the fourth time on a bank form,” says Don Raftery, Head of Banking – Americas at Coalition Greenwich.

2022 Greenwich CX Leaders—Commercial Banking

The 2022 Greenwich CX Leaders in U.S. Commercial Small Business and Middle Market Banking all combine high-touch service with valuable insights and advice that help their clients optimize business performance. For the most part, the banks on this year’s Greenwich CX Leaders list are able to deliver that superior client experience by deploying experienced bankers who spend time with client leaderships teams in order to develop a deep understanding of the business and its needs.

For Smaller Banks, Now is the Time to Strike

Community and regional banks have done an impressive job protecting their client bases and market share from bigger banks and national competitors. To a large extent, they have done so by leaning on “white glove” service delivered in person by a relationship manager or other dedicated staff. That model was especially successful during the COVID-19 crisis, when relationship managers (RMs) with strong existing relationships with their clients were able to facilitate companies’ PPP applications and provide additional support. That performance elevated client perceptions of these banks due in no small part to the inconsistent service experienced by clients of many national banks during the pandemic.

Here is how one commercial banking client described his experience working with a community bank: “The personal banking connections and people we work with make all the difference. In this digital world, we still need good people for great partnerships. I appreciate the people the most.” Another community bank client had this to say about his provider: “We enjoy working with our commercial loan officer, they truly care about how you and our business is doing and want to help us succeed.”

Because superior service is so central to their value proposition, recent declines in client satisfaction are an ominous sign for smaller banks. These banks will need to pull out all the stops to reverse this trend, using all resources at their disposal, including even more intense coverage from RMs and the introduction of whatever digital tools they can afford to adopt. “Smaller banks often can’t afford to digitize entire workflows, but they can identify the most impactful client pain points and specifically target technology investments to alleviate them,” says Chris McDonnell.

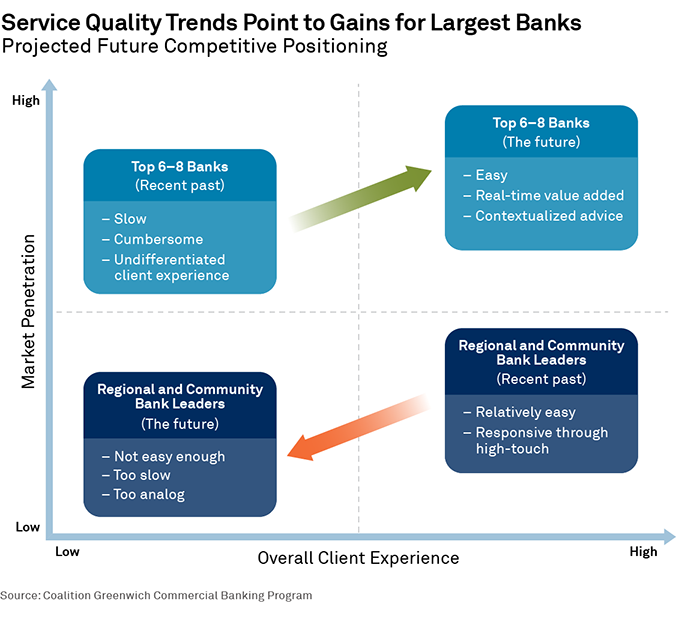

It’s imperative that smaller banks act immediately to shore up service quality, NPS scores and client relationships. The reason: National banks have spent the past decade investing in transformative technology. Those investments are beginning to pay dividends.

One of the biggest factors in companies’ selection of a bank is “ease of doing business”. Traditionally, that measure has been a point of positive differentiation for small banks, who dispatched dedicated bankers to ensure a smooth experience for clients. Meanwhile, ease of doing business has been the Achilles’ heel of the national banks, whose sprawling organizations and bureaucratic processes created frequent obstacles for clients.

But the digital tools now being deployed by national banks are aimed squarely at eliminating past pain points for clients and addressing the ease-of-doing-business issue. These banks are working to perfect intuitive self-service platforms that clients can access through any device, anytime, anywhere. They are incorporating e-signatures, digital document vaults, autofill, and other digital tools to streamline client onboarding and eliminate many of the headaches associated with KYC, ALM and other documentation requirements.

These systems are getting smarter every day. Banks are integrating data analytics and artificial intelligence to anticipate client needs and deliver timely and relevant recommendations. “In simplest terms, technology is making it much easier for small business and midsize companies to do business with national banks,” says Chris McDonnell.

The only good news for smaller banks is that national banks are still midstream in this transformation. It could be as long as three years before national banks start reaping the full payouts from their technology investments. In the meantime, clients could experience bumps in the road as their banks navigate the implementation process.

For that reason, the time for smaller banks to strike is now. Expectations about the future economic outlook are lower today among small businesses and middle market companies than they were during the global financial crisis of 2007–2008. It is in uncertain environments like these that business owners and executives are most in need of advice and support from their banks. “In strong economic conditions, it’s tough for banks to stand out to their clients,” says Don Raftery. “Banks win client loyalty by rising to the occasion in tough times. Now is the time to seize the moment and deliver an exceptional client experience that translates into expanded share of wallet and market share.”

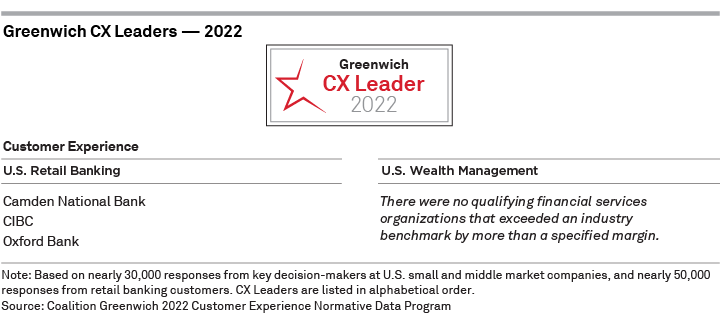

2022 Greenwich CX Leaders—Retail Banking

The 2022 Greenwich CX Leaders in Retail Banking excel in customer service. They impress their customers with their personnel’s product knowledge, and make it easy for their clients to bank through seamless transactions. Although some of the smaller community banks on the list might lack the digital capabilities of larger rivals, they make up for it with prompt error resolution and personal service.

“Stellar customer service and one of the best products/fee schedule combination in the industry.” That’s how a client of one top-performing retail bank described her experience. Another retail customer lauded the “great personal service, professional behavior and friendly personnel at my local branch.”

About the Greenwich CX Leaders

The Greenwich CX Leaders in U.S. Commercial Small Business, Middle Market Banking and U.S. Retail Banking are banks that must achieve scores that exceed the industry benchmark by a specified margin in three categories:

- Overall satisfaction

- Likelihood to recommend

- Ease of doing business

These scores are derived from interviews with key corporate decision-makers at more than 30,000 companies and nearly 50,000 retail customers. Any bank that submits CX data to Coalition Greenwich is eligible for the CX Leader designation.

Don Raftery, Chris Mcdonnell, Yolanda Colon, and Carol Greene provide strategic advice and optimization solutions on customer experience management for banks globally.

MethodologyAwards are given to banks whose performance on an index of questions commonly included in Customer Experience programs exceeds an industry benchmark by more than a specified margin.

The Commercial Small Business and Middle Market Banking CX Awards are based on an index comprising the following questions:

- Overall satisfaction

- Likelihood to recommend

- Ease of doing business

The Commercial Small Business and Middle Market Banking benchmark is based on the Coalition Greenwich 2021 Commercial Banking Study, which includes interviews with key corporate decision-makers at more than 30,000 companies. Greenwich CX Leaders are determined at a national level.

The Retail Banking Awards are based on an index comprising the following questions:

- Overall satisfaction

- Likelihood to recommend

- Ease of doing business

The Retail Banking benchmark is based on the Coalition Greenwich 2021 Retail Banking Study covering nearly 50,000 retail banking customers.

The Wealth Management Awards are based on an index comprising the following questions:

- Overall satisfaction

- Likelihood to recommend

- Ease of doing business

The Wealth Management Banking benchmark is based on the Coalition Greenwich 2021 Retail Banking Study covering nearly 50,000 retail banking customers.

Award thresholds for both Commercial Small Business and Middle Market Banking and for Retail Banking have been set to be challenging but attainable. However, because CX clients are compared to a benchmark that represents the entire market, not just the CX clients, it is possible for all CX clients to win awards or for no CX clients to win awards.

Index calculation details: The Commercial Small Business and Middle Market Index is calculated as the mean of the three questionnaire items listed above and the Retail Banking Index as the mean of the three questionnaire items listed above. Scores originally measured on a 5-point scale are adjusted linearly to a 0-100 scale. The adjustment is as follows: (mean -1) * 25. In the case of questions that use 10-point scales, ratings are adjusted to 5-point scales using probabilistic assignments based on Coalition Greenwich research.