In recent years, digital banking platforms (computers, tablets and mobile phones) have joined the branch and call center as core banking channels. However, few banks have taken the essential step of extending their customer experience program to digital channels.

Banks must work to deliver a customer experience that is consistent at every point of contact with its customers. To learn more, download Cracking the Code: Digital Channels and the Customer Experience.

Bottom Line

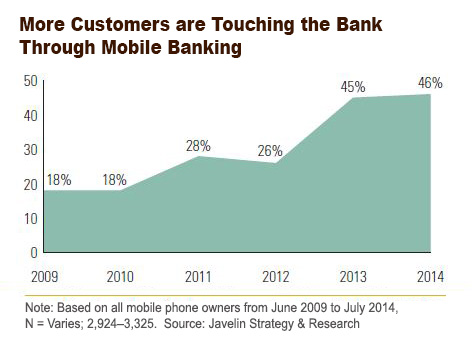

- As customers shift many of their day-to-day transactions to digital channels, they are no longer differentiating between their financial institutions and the institutions’ websites or mobile platforms.

- Digital channels must be viewed as equal in importance to the overall banking business. However, in the vast majority of banks, efforts to track and improve digital interactions remain entirely separate from the CE program.

- Banks must work to deliver stellar customer experience that is consistent at every point of customer contact, including a branch office, via telephone, or on a computer or mobile device.

For more information about extending your customer experience program to include your digital channels, download Cracking the Code: Digital Channels and the Customer Experience.