Business owners and executives are now carrying over their retail digital banking practices into their commercial banking needs. As a result, banks must be on guard against one potential impact: higher switching rates.

Commercial banking relationships are much “stickier” than retail banking relationships. In the commercial world, steps like changing cash management providers and even opening an account at a new bank can be long and cumbersome processes.

Bottom Line

As business owners and executives become more accustomed to using digital and other self-service channels for their own personal banking needs, online and digital capabilities will become increasingly important elements of commercial banking relationships.

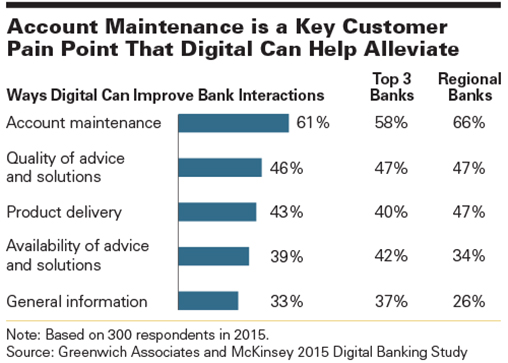

Banks should be just as focused on digital platform development in commercial banking as they are in retail banking. They should target account maintenance issues that business owners and executives identify as the key “pain points” they seek to avoid by using online and mobile channels.