Banks today are sustaining spends of millions of dollars annually on their digital corporate and commercial banking platforms. It is easy to focus on the bells and whistles of the feature sets, however the ROI from these outlays can be difficult to quantify, particularly for “user experience” factors such as ease of use.

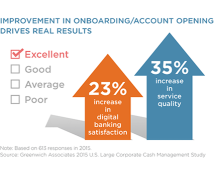

The ROI is clearer for bank processes that are largely manual and paper-based (e.g., account opening). Greenwich Associates believes that smart digital implementations should always include a well thought out client onboarding process.

Educating and delivering the right customer experience for a new bank client and setting up a new user in an existing client organization is not always straightforward. Several factors contribute to this complex problem.

- Onboarding means different things within a user population. As stakeholders, security administrators and finance managers only touch a single part of the system. Is onboarding meant to drive an end-to-end understanding of the system for all users, or only for the aspect of the systems that a particular user will be interacting with? In reality both viewpoints are correct and in scope.

- Onboarding is a big number problem. Onboarding is often a shared process between bank personnel and client-side administrators. To the extent possible, “internal” and “external” users should rely on the same set of digital tools to set up new accounts, assign user roles, create account groups, etc. A third set of stakeholders, relating to the documentation required by regulators, must remain top of mind as banks plan to roll out more digitized onboarding processes.

- Failure is the result of small, frequent errors in processes. Customers are more often lost due to “death by 1,000 cuts” rather than a single catastrophic event. Implementations with disparate, unintegrated systems, ones reliant on repetitive manual data entry, and those that lack clear hand-off transitions are particularly challenging to introduce to user populations.

- Users struggle with self-service help options. The inclination is to reach out to a live person for help—not all issues can be addressed in automated ways.