Consumers and business owners age 18–34 are perceived as fickle and self-centered, skeptical of big banks and difficult to serve. But for the most part Millennials want the same things from their banking relationships as their 35-and-older counterparts: a reliable place to deposit and hold cash and conduct transactions, a source of short- and long-term credit, and a trusted adviser.

One thing is clear: As the largest generation in history comes into financial maturity, bankers are scrambling to adapt and respond to a huge variety of digital development and marketing challenges, and that’s especially true in small business banking.

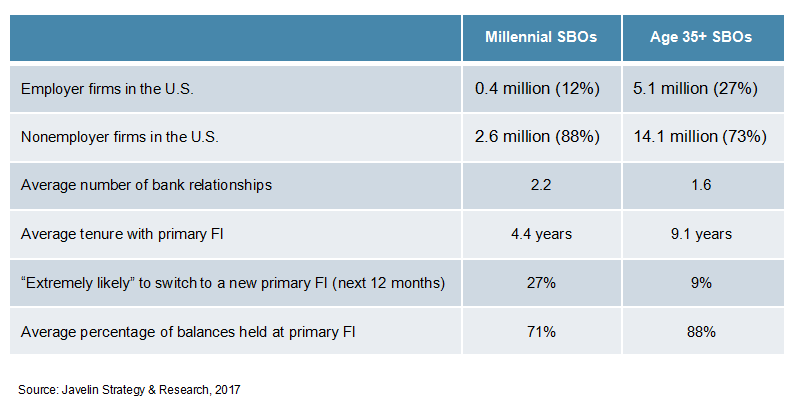

There are very compelling reasons banks serving small business customers should embrace the oncoming wave of Millennial business owners. However, FIs risk falling behind in the race to acquire Millennial-owned businesses as they become caught in small business banking limbo between consumer and commercial platforms that are evolving into more innovative, personalized, and automated tools to manage personal and business finances.

Read the Javelin Strategy & Research report, Small Business Banking for Millennials to learn more.