Table of Contents

Good customer experience is easy to recognize but can be difficult to deliver. For that reason, Greenwich Associates is launching the Greenwich CX Leaders—an award recognizing leadership in the increasingly important field of customer experience.

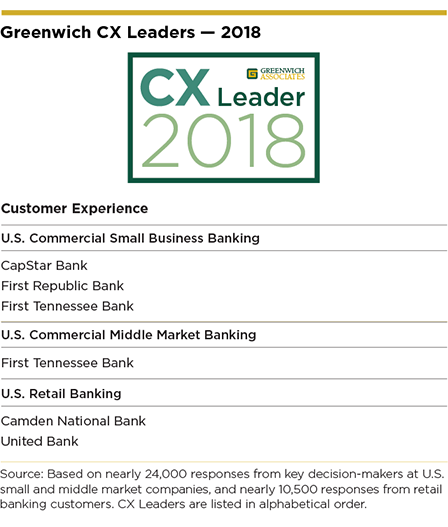

The 2018 Greenwich CX Leaders in U.S. Commercial Small Business Banking are CapStar Bank, First Republic Bank and First Tennessee Bank. The winner in U.S. Commercial Middle Market Banking is First Tennessee Bank. In U.S. Retail Banking, the CX Leaders are Camden National Bank and United Bank.

“These CX Leaders have focused on creating great experiences for their customers and employees by placing their feedback at the center of everything they do,” says Ron Balmer, Greenwich Associates Managing Director, Customer Experience.

Outpacing the Industry in CX

Greenwich Associates administers Customer Experience research on behalf of its clients. Beyond giving banks critical diagnostic guidance to help them develop strategies and tactics for improving the quality of their customers’ experiences, it also provides a basis for evaluating each bank’s performance relative to the market.

Greenwich CX Leaders in U.S. Commercial Small Business and Middle Market Banking and U.S. Retail Banking are banks that achieve scores that exceed the industry benchmark by a specified margin, on an index comprising three questionnaire items:

- Overall satisfaction

- Likelihood to recommend

- Likelihood to continue using

These banks have some important things in common. In order to excel in these three critical categories, all the Greenwich CX Leaders have a clear strategic plan in place, supported by the organization with resources and the attention of senior leadership. Those plans start by mapping individual customer interactions (or customer journeys), and then allocate the people, systems, technology, and processes needed to enable those experiences, correct problems, and drive the cultural change that improves long-term business performance.

Launching the Greenwich CX Leaders Program

The Greenwich CX Leaders in this, our inaugural year, were chosen from the list of Greenwich Associates clients in CX. Going forward, any bank that applies for consideration and meets the requirements will be eligible for the designation.

“Our mission is to help create and implement programs that deliver a culture of customer centricity,” said Jacqueline Vose, Greenwich Associates SVP and Principal of Customer Experience. “We partner with organizations that have decided to stop simply measuring and reporting, and are ready to evolve their CX programs to more effectively drive business outcomes.”

Managing Director Ron Balmer and Senior Vice President Jacqueline Vose provide clients with customer experience management optimization solutions.

MethodologyAwards are given to banks whose performance on an index of questions commonly included in Customer Experience programs exceeds an industry benchmark by more than a specified margin.

The Commercial Small Business and Middle Market Banking Awards are based on an index comprising the following questions:

- Overall satisfaction

- Likelihood to recommend

- Likelihood to continue using

The Commercial Small Business and Middle Market Banking benchmark is based on a rolling four quarters of the Greenwich Associates Commercial Banking Study, which includes interviews with key corporate decision-makers at nearly 24,000 companies. Greenwich CX Leaders are determined at a national level.

The Retail Banking Awards are based on an index comprising the following questions:

- Overall satisfaction

- Likelihood to recommend

- Likelihood to switch—where Greenwich Associates CX derives likelihood to continue using

The Retail Banking benchmark is based on the Greenwich Associates 2017 Retail Banking Study covering nearly 10,500 retail banking customers.

Award thresholds for both Commercial and Middle Market Banking and for Retail Banking have been set to be challenging but attainable. However, because CX clients are compared to a benchmark that represents the entire market, not just the CX clients, it is possible for all CX clients to win awards or for no CX clients to win awards.

Index calculation details: The Commercial Small Business and Middle Market index is calculated as the mean of the three questionnaire items listed above and the Retail Banking Index as the mean of the three questionnaire items listed above. Scores originally measured on a 5-point scale are adjusted linearly to a 0-100 scale. The adjustment is as follows: (mean -1) * 25. In the case of questions that use 10-point scales, ratings are adjusted to 5-point scales using probabilistic assignments based on Greenwich Associates research.