Companies in the U.K. and continental Europe see Brexit as a real possibility, and given their deep levels of integration across the two markets, corporate treasury officials think a U.K. exit would have a significant impact on their own businesses and overall trade.

In light of this, it is surprising to find that few executives have put in place security measures to protect their companies from the expected volatility.

Bottom Line

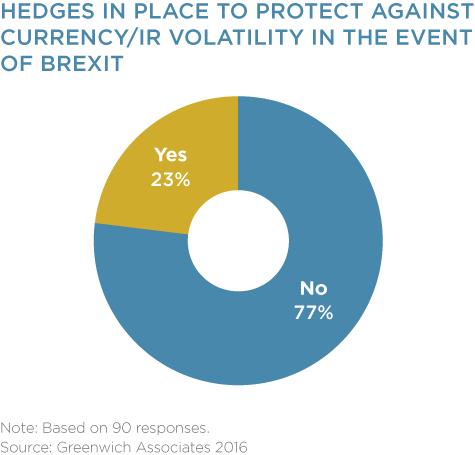

Fewer than 1 in 4 corporate treasurers interviewed has put in place any hedges to protect against currency and/or interest-rate volatility — the two areas of risk exposure cited most frequently by study participants.

Companies have taken even less action on other risks that they see as possible but harder to measure and protect against.

Among such risks cited by financial officers are significant changes in regulation effecting trade and capital mobility, decrea sed access to liquidity and increasing cost of funding, and the possible introduction of a withholding tax.

Read our Greenwich Report, Brexit: Is Hope a Strategy?, to learn more!