Today, relationship managers (RMs) need to gain a competitive advantage through consultative selling and tiered-client servicing. Often overlooked, the skills of those managing RMs must also evolve to sustain that competitive advantage.

Bankers responsible for managing front-line RMs must develop a much different skill set than the one that helped create their own success in the traditional credit underwriting and product sales discipline.

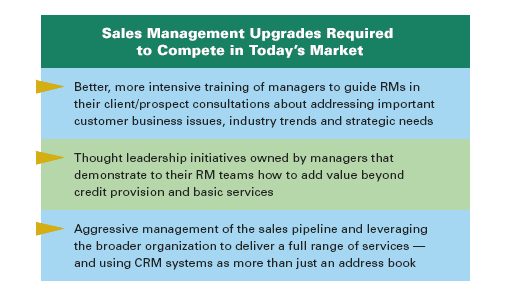

Instilling change in RM behaviors requires banks to overhaul their sales management techniques. A significant roadblock must be overcome: regional managers, business heads and sector leaders clinging to a traditional “credit underwrite” approach to business development.

Bottom Line

Senior management must make the upgrade of sales management a key priority to overcome organizational inertia to change RM behavior. RMs capable of consultative selling/servicing, if effectively coached, will be a substantial differentiator.

A key to long-term success will be the ability of managers to transition into full-fledged sales leaders with a skill set applicable to coaching in new behaviors. RMs should not be the only ones trai ned and held accountable to delivering new sales/client relationship management approaches.

As successfully serving clients becomes increasingly complex, banks will feel the pressure to enhance ease of doing business – now the single most important driver of banking relationship quality – as a strategic differentiator. Sales managers are a key part in making it easy to do business with a bank.