As companies look to maximize cash flow in a continually sluggish economy, they increasingly focus on:

- Making their business’ payments process more efficient

- Accelerating receipt of payments

- Reducing exposure to payment fraud

- Enhancing payments data integration into accounting systems

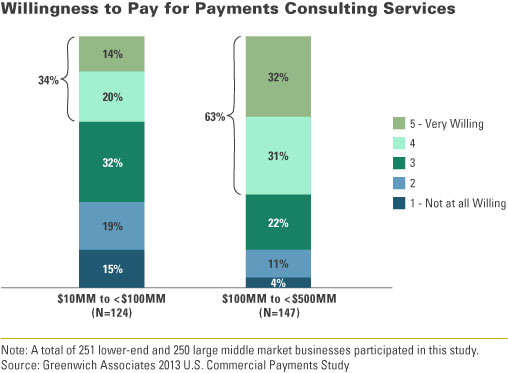

Exciting revenue opportunities are emerging as businesses express a willingness to pay their primary bank for advanced payment products and services. One-third of the lower-end middle market businesses and almost two-thirds of the large middle market businesses that would value a payments consulting service say they are willing to pay their primary bank for a payments consulting service.

The data demonstrates that businesses are looking for their bank to be a true partner as they accelerate their adoption of electronic payments in pursuit of increased cash flow, greater cost efficiency, and enhanced customer and supplier relationships, all the while minimizing their exposure to payments fraud.

These findings represent an exciting new opportunity for banks to fulfill their role as a trusted advisor, improve customer retention and create a new revenue stream in the process.