Table of Contents

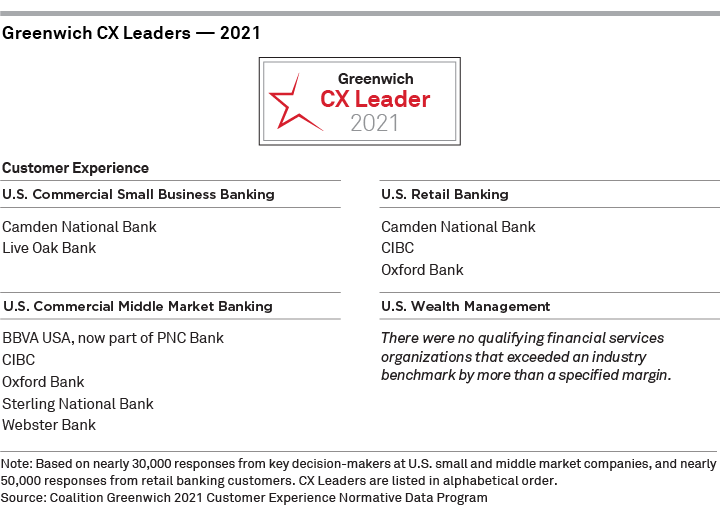

The 2021 Greenwich CX awards recognize financial services leaders that have excelled in customer satisfaction, customer loyalty and creating an environment that is easy for the customer to do business. This year put a spotlight on serving the customer. As the banking industry experienced softening in client loyalty coming out of the pandemic, Greenwich CX Leaders found creative approaches to supporting their clients. While in-person interactions decreased and customer experiences moved mostly online, the importance of providing meaningful customer interactions remained.

“Meaningful customer interactions were redefined in 2021. After a year like no other, banking is accelerating its evolution to meet new and heightened customer expectations,” said Jacqueline Vose, Head of Client Experience and Community Banking at Coalition Greenwich. “Customers forced to utilize video calls and non-traditional channels found their banks rising to the challenge. The pandemic turbocharged digital adoption, but the months following highlighted the fact that digital banking is about more than scale—it’s also about offering a great experience.”

The majority of Greenwich CX Leaders this year are community banks. Community banks were challenged with maintaining their renowned high standard of customer service while managing an influx of customers due to PPP. Bankers replicated their proven relationship approach through new channels—creating a “tech and touch” model.

U.S. Commercial Small Business Banking

Camden National Bank: For two years running, Camden National Bank has outperformed industry standards in ease of doing business among small business customers. With an emphasis on being accessible and responsive to their business customers’ needs, Camden National Bank maintained their high standard of customer satisfaction while simultaneously delivering on PPP assistance over the past year.

Live Oak Bank: Live Oak Bank is a digital bank that serves small business owners in all 50 states and was the leading SBA and USDA lender by dollar volume in 2020. In 2021, Live Oak doubled down on their mission to be America’s small business bank by being true to their mantra “to treat every customer like the only customer.”

U.S. Commercial Middle Market Banking

BBVA USA, now part of PNC Bank: BBVA relationship managers know the key to success includes your bank’s business partners. BBVA excels at bringing in the right experts to meet the needs of their middle market clients. BBVA announced the merger with PNC Bank in Q4 2020. The BBVA leadership team and relationship managers connected with clients to convey the continued level of service. That proactive communication maintained customer satisfaction.

CIBC: CIBC’s relationship managers focused on creating end-to-end financial solutions to address every business need. After a year of disruption, the middle market banking customers were clear that CIBC relationship managers know their business and recommend innovative solutions to help them grow their business.

Oxford Bank: As anticipated with the pandemic, digital channel usage among middle market clients increased by double digits year over year at Oxford Bank. What was not expected were the strong satisfaction rates clients reported. The Oxford digital experience was blending with the high service model seamlessly.

Two high-performing organizations achieved CX Leader recognition and announced a merger in 2021. Webster and Sterling have much in common, including distinguished client service in middle market banking.

Sterling National Bank: Sterling National Bank has made the credit experience easy for middle market clients, rating 10 percentage points higher than the industry average. It is another proof point that Sterling National Bank has created customized commercial banking solutions with the guidance of a dedicated relationship manager.

Webster Bank: Webster Bank relationship managers excel as strategic partners to their middle market clients. Webster believes that they can better service their commercial customers when their relationship managers understand the challenges unique to their client’s industry.

U.S. Retail Banking

Camden National Bank: For the fourth consecutive year, Camden National Bank is being recognized as a CX Leader in retail banking—a testament to their steadfast commitment to creating remarkable experiences for customers. Through high-tech, high-touch service channels, Camden National Bank excels at meeting customers where they’re at. Last year, they fielded more than double the number of support calls and online chats, while also introducing an online scheduling tool for convenient in-person meetings.

CIBC: Due to the pandemic, CIBC’s retail customers increased usage of the branch drive-thru and call center. The CIBC retail team responded positively to the shift in customer behavior, improving overall satisfaction in both channels. Retail customers noted CIBC employees’ ability to build rapport with them without being in person as a key reason for best-in-class satisfaction ratings.

Oxford Bank: Oxford Bank customers repeatedly stated that the retail employees treat them with respect. From account opening to problem resolution, Oxford retail employees understand what it takes to support their customer. It seems so easy, but only Oxford Bank is consistently delivering on this table-stakes service model that drives customer loyalty.

About the Greenwich CX Leaders

The Greenwich CX Leaders in U.S. Commercial Small Business, Middle Market Banking and U.S. Retail Banking are banks that must achieve scores that exceed the industry benchmark by a specified margin in three categories:

- Overall satisfaction

- Likelihood to recommend

- Ease of doing business

These scores are derived from interviews with key corporate decision-makers at more than 30,000 companies and nearly 50,000 retail customers. Any bank that submits CX data to Coalition Greenwich is eligible for the CX Leader designation.

Jacqueline Vose is the Head of Client Experience and Community Banking at Coalition Greenwich and provides strategic advice and optimization solutions on customer experience management for banks globally.

MethodologyAwards are given to banks whose performance on an index of questions commonly included in Customer Experience programs exceeds an industry benchmark by more than a specified margin.

The Commercial Small Business and Middle Market Banking CX Awards are based on an index comprising the following questions:

- Overall satisfaction

- Likelihood to recommend

- Ease of doing business

The Commercial Small Business and Middle Market Banking benchmark is based on the Coalition Greenwich 2020 Commercial Banking Study, which includes interviews with key corporate decision-makers at more than 30,000 companies. Greenwich CX Leaders are determined at a national level.

The Retail Banking Awards are based on an index comprising the following questions:

- Overall satisfaction

- Likelihood to recommend

- Ease of doing business

The Retail Banking benchmark is based on the Coalition Greenwich 2020 Retail Banking Study covering nearly 50,000 retail banking customers.

The Wealth Management Awards are based on an index comprising the following questions:

- Overall satisfaction

- Likelihood to recommend

- Ease of doing business

The Wealth Management Banking benchmark is based on the Coalition Greenwich 2020 Retail Banking Study covering nearly 50,000 retail banking customers.

Award thresholds for both Commercial Small Business and Middle Market Banking and for Retail Banking have been set to be challenging but attainable. However, because CX clients are compared to a benchmark that represents the entire market, not just the CX clients, it is possible for all CX clients to win awards or for no CX clients to win awards.

Index calculation details: The Commercial Small Business and Middle Market Index is calculated as the mean of the three questionnaire items listed above and the Retail Banking Index as the mean of the three questionnaire items listed above. Scores originally measured on a 5-point scale are adjusted linearly to a 0-100 scale. The adjustment is as follows: (mean -1) * 25. In the case of questions that use 10-point scales, ratings are adjusted to 5-point scales using probabilistic assignments based on Coalition Greenwich research.