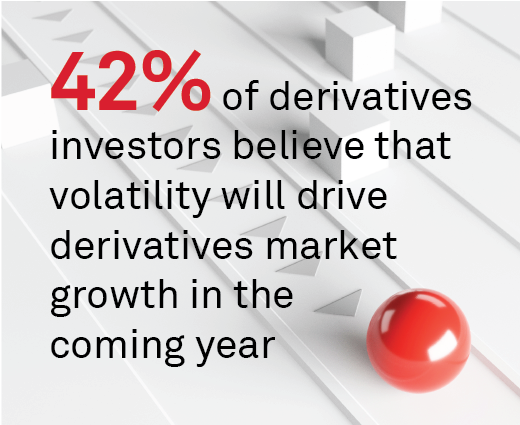

The derivatives market in 2024 will focus on increasing efficiency in response to key global and industry drivers that are adding costs and risks to trading desks. At the same time, opportunities for growth are also forcing technology responses that will help manage through the key challenges that participants state will shape the future of the market.

Coalition Greenwich and FIA identified three main subsets of institutions participating in a recent research study: end users (asset managers and hedge funds), intermediaries (brokers, dealers, clearing firms) and infrastructures (exchanges and clearinghouses).

Derivatives Market Structure 2024: Focusing on Capital and Workflow Efficiency identifies the biggest challenges and growth opportunities facing the derivatives industry and analyzes the improvements to market structure, technology and workflows that market participants believe will be needed to accommodate expansion in global trading volumes.

Download the paper to learn more!